In this Titan Company Analysis we will see what is it that makes Titan Industries one of the most popular companies in India?

Titan has a rich history, and it has been synonymous with watches for about three decades now. Titan is India’s largest integrated watch manufacturer and the fifth largest globally.

But over the years, the company has diversified its business segment into jewellery, eyewear, and other peripheral segments, including fragrance, wallets, handbags, and clothing. They have focussed on segments that have historically been unorganized, and they try to become a large organized player in that segment. So this has been their main strategy.

Titan has 20+ brands in its product portfolio. It also owns a license to distribute some international brands in India, including Tommy Hilfiger, Kenneth Cole, Anne Klein, to name a few. Titan has a strong presence in the market with ~1,700+ retail stores in India and exports to ~32 countries with 11,000+ multi-brand outlets sell Titan watches globally.

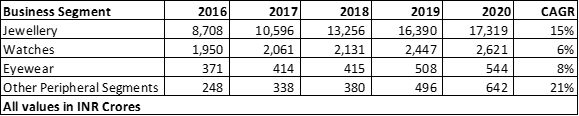

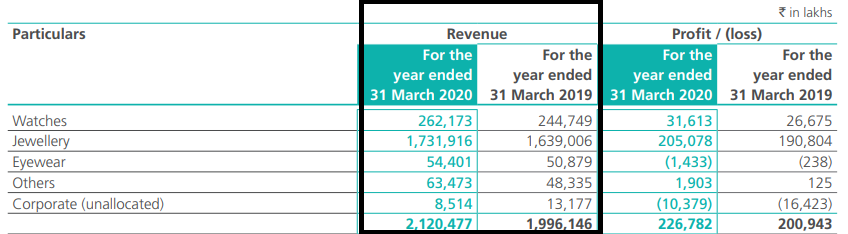

Now, the question is, which segment drives revenue for Titan?

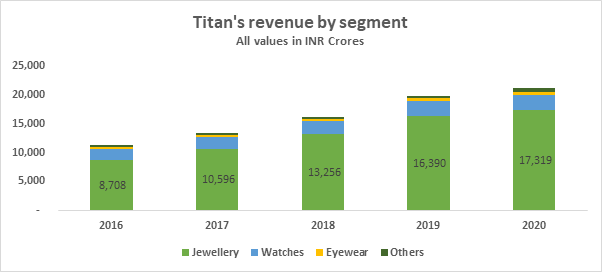

Historically, Titan used to generate ~70% of the revenue from the sale of watches. But today, the watch segment generates merely 13% of revenue for the company. The jewellery segment is a significant source of revenue and generates ~82% of revenue for Titan. Eyewear and other peripheral segments generate just 5% of the revenue for the company.

- Watches: ~13%

- Jewellery: ~82%

- Eyewear: ~2%

- Others (Fragrance, wallets, handbags etc.): ~3%

If we look at the segmental revenue of Titan over the last 5 years, then the jewellery segment has been the significant revenue driver.

***** AR10 – Annual Report Sprint – Batch 3 – Details here ******

Let’s look at the growth of these segments.

Over the last 5 years, Titan’s peripheral business segment (Fragrance, wallets, handbags, and clothing) is growing very fast, with a CAGR of 21%. But the growth of this segment will not significantly impact the company’s finances as it contributes merely 3% of revenue for the company.

The jewellery segment of Titan is also growing at great speed, with a CAGR of 15%. And this will have a significant impact on the company’s finances as it contributes a whopping 82% to Titan’s total revenue.

The watches and eyewear segment is growing at par. Although the growth of the watch segment is steady, Titan holds ~65% of the market share in the watch industry. And it is expanding the product portfolio of the watch segment to smartwatches and wearables to maintain its market position.

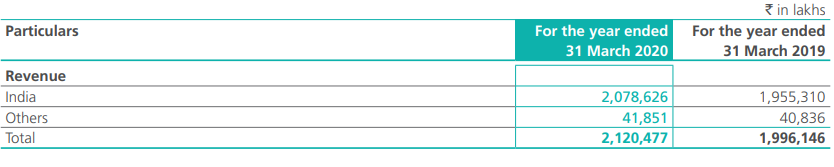

What about Geographical Diversification?

India is a primary market for Titan and contributes 98% to the company’s total revenue.

International markets contribute just 2% to the company’s total revenue. UAE is Titan’s largest market outside India. And 50% of Titan’s international watch business is dependent on Middle East markets.

Titan has also launched the first international jewellery store – Tanishq in Dubai, intending to expand its global footprints.

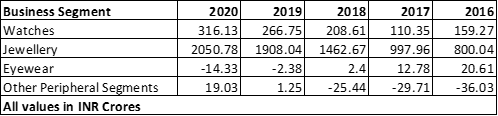

Let’s look at the Profitability now.

If we look at the segmental profits of Titan over the last 5 years, then profits from the watch and wearables segment has grown at a CAGR of ~15%. And it operates at an average EBIT margin of ~14%.

The jewellery segment is clearly a cash cow for Titan as it contributes a significant portion to the company’s total profits and operates at an average EBIT margin of ~12%. Moreover, profits for the jewellery segment has grown at a CAGR of 21% over the last 5 years.

And over the last two years, there has been a significant shift in Titan’s segmental profits where the eyewear segment is running into losses, and other peripheral segments have become profitable.

This is primarily because Titan has launched new brands in these segments and expanded its distribution network for the peripheral segments. Eyewear is facing significant competition in the market as it holds ~10% of the organised market share. India has a lower penetration rate in some product categories like contact lenses and sunglasses.

By now, we understand that Titan is all about the jewellery business. So, let’s try and dissect the segment.

Titan’s presence in the jewellery market in India

Tanishq is a major brand operated by Titan in the jewellery segment with 350+ stores in 200 cities. It commands a market share of ~5% in the organised jewellery market in India.

Tanishq also operates Zoya- a luxury segment for jewellery business and holds ~20% share across the Tanishq brands. Mia is another jewellery sub-brand operated by Tanishq to target working women in India especially.

They seem to have a plan in place for expansion. Tanishq has recently entered into a partnership with Caratlane to target tech-savvy customers, especially for low ticket purchases. It currently holds a 62% stake in Caratlane.

Why is the jewellery segment so important for Titan?

India is the largest importer of gold globally and imports around 800-900 tonnes of gold annually to meet the jewellery industry’s demand primarily. And gold jewellery forms around 80% of the Indian jewellery market.

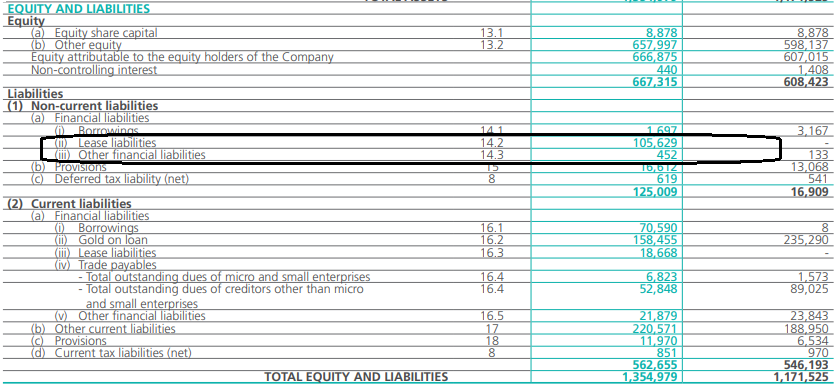

But the significant challenge in the jewellery industry is the fluctuating gold prices and heavy import duty by the Government that increases the cost of manufacturing jewellery. So, Titan, to avoid gold price fluctuation, purchases most of its gold on lease.

On a closing remark, there is a huge opportunity size in the product lines they have and given their distribution network; they can keep adding product lines that come up.

Also, Tata Digital seems to be working on a super app. With the acquisition of Dunzo, Big Basket and 1mg, they plan to add more products and leverage their reach.

Other Trending Posts in this Series – Spotify | Netflix | Amazon

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.