Covid had a significant impact on the Media and Entertainment Industry the world over. That affected India’s Industry as well, for companies like PVR.

Let’s understand the Industry

The size of the M&E Industry was Rs.1.38 trillion (USD 20 Billion) in 2020, falling 24% from Rs.1.82 trillion (USD 25 Bn). Filmed entertainment forms 5% of the M&E Industry.

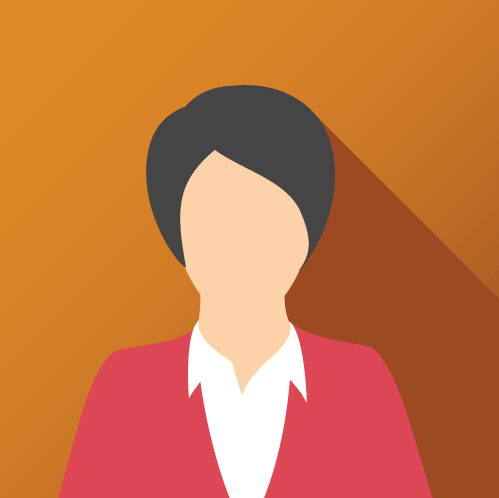

Indian Film industry holds several titles, including the largest producer of films, approximately 1500 – 2000 per year compared to 700 in the USA and Canada. India is leading the film industry in terms of tickets sold. It is the 5th most significant box office market in terms of revenue. Despite this, the screen per capita is low, indicating an opportunity for expansion.

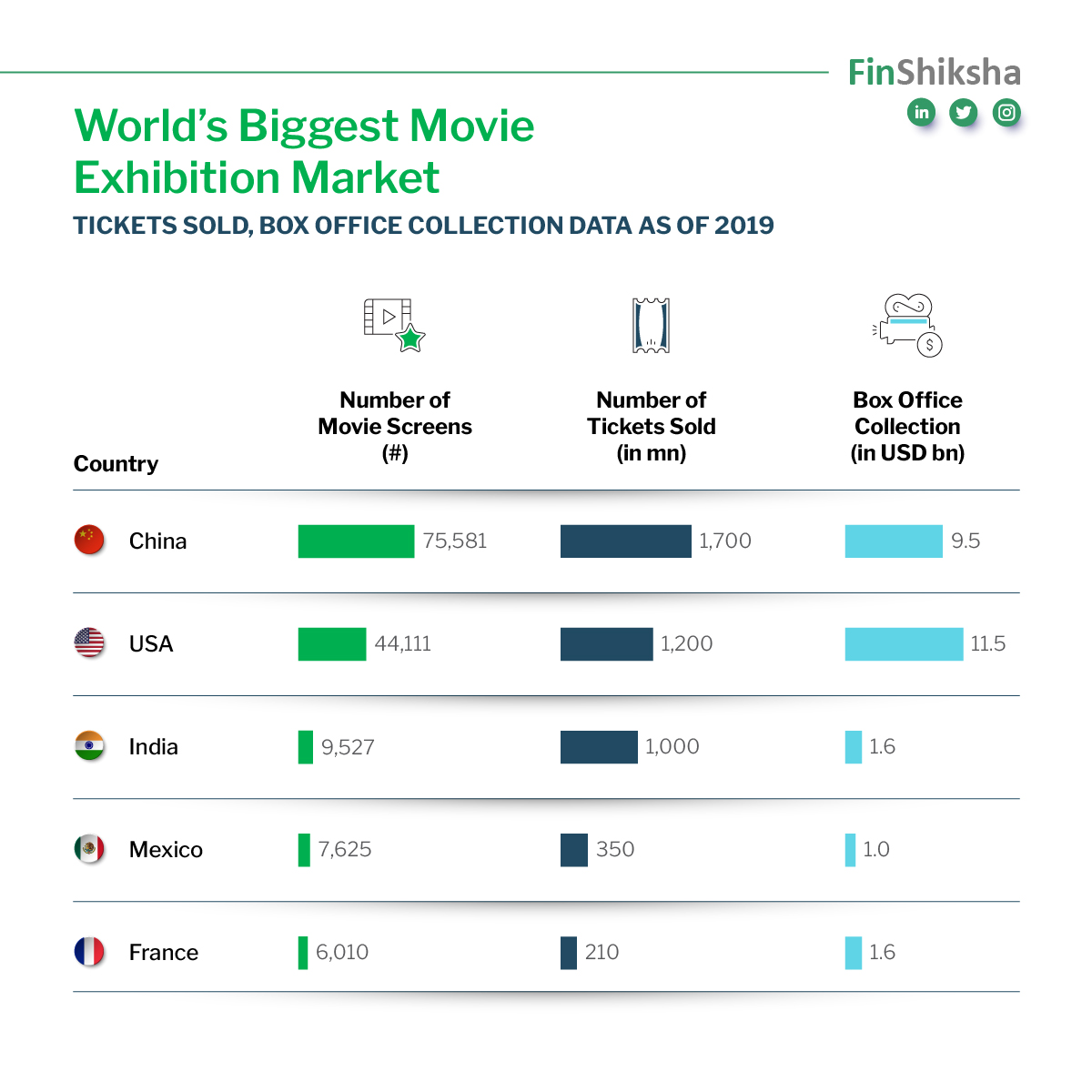

Indian film industry consists of movies in Hindi, Hollywood and regional movies. Regional movies are an integral part of the Indian film Industry. Regional cinemas still contribute to more than 50% of box office collection.

What about the exhibition business?

What about the exhibition business?

In the film industry, the exhibition is a crucial component. After Covid, the OTTs have become prevalent, but before that, theatres were big – it will remain relevant in India though post-Covid. The reason is – for a lot of people, going to theatres and watching movies is still considered a luxury and an event.

The working:

- After the movie is produced, the distributor acquires ‘Theatrical Rights’ or the right to distribute the film in a particular territory for a limited period by paying a minimum guarantee to the producer.

- The distributor then talks with theatre owners about the release of the movie.

- Theatre owners are responsible for public screening for paying customers.

- The distributor secures a written contract stipulating the amount of the ticket sales the exhibitor will be allowed to retain (usually a percentage of the collection) and the number of film screens.

- Generally, distributors receive weekly returns from theatre owners. Usually, the distributor’s share in the case of the theatre is 50% of the 1st week’s collection, 42% of the 2nd week’s collection and 37% of the 3rdweek’s collection and after that fixed at 30% of the collection.

- Typically, single-screen owners give distributors a 70-90% share of the total collection.

- The distributor collects the amount from exhibitors, takes his commission, and remits the rest to the movie producer.

***** AR10 – Annual Report Sprint – Batch 3 – Details here ******

Examples of Players from Indian Market Perspective:

- Producer – any individual or distributors (like YRF or Red Chillies Entertainment)

- Distributor – YRF, Dharma Productions

- Digital Operator – UFO Movies, Prime Focus

- Exhibitor – PVR Cinema, INOX, Cinepolis

- OTT – Netflix, Amazon Prime

PVR is one of the prominent players in the Media & Entertainment industry.

The multiplex industry is primarily an oligopoly Market with a 70% market controlled by the top 4 players.

PVR operates 846 screens in 176 cinemas in 71 cities in India and Sri Lanka,, with an aggregate seating capacity of approximately 1.82 lakhs seats.

We also need to understand the business dynamics of PVR. So let’s focus on that..

Revenue Drivers and Cost Drivers for PVR

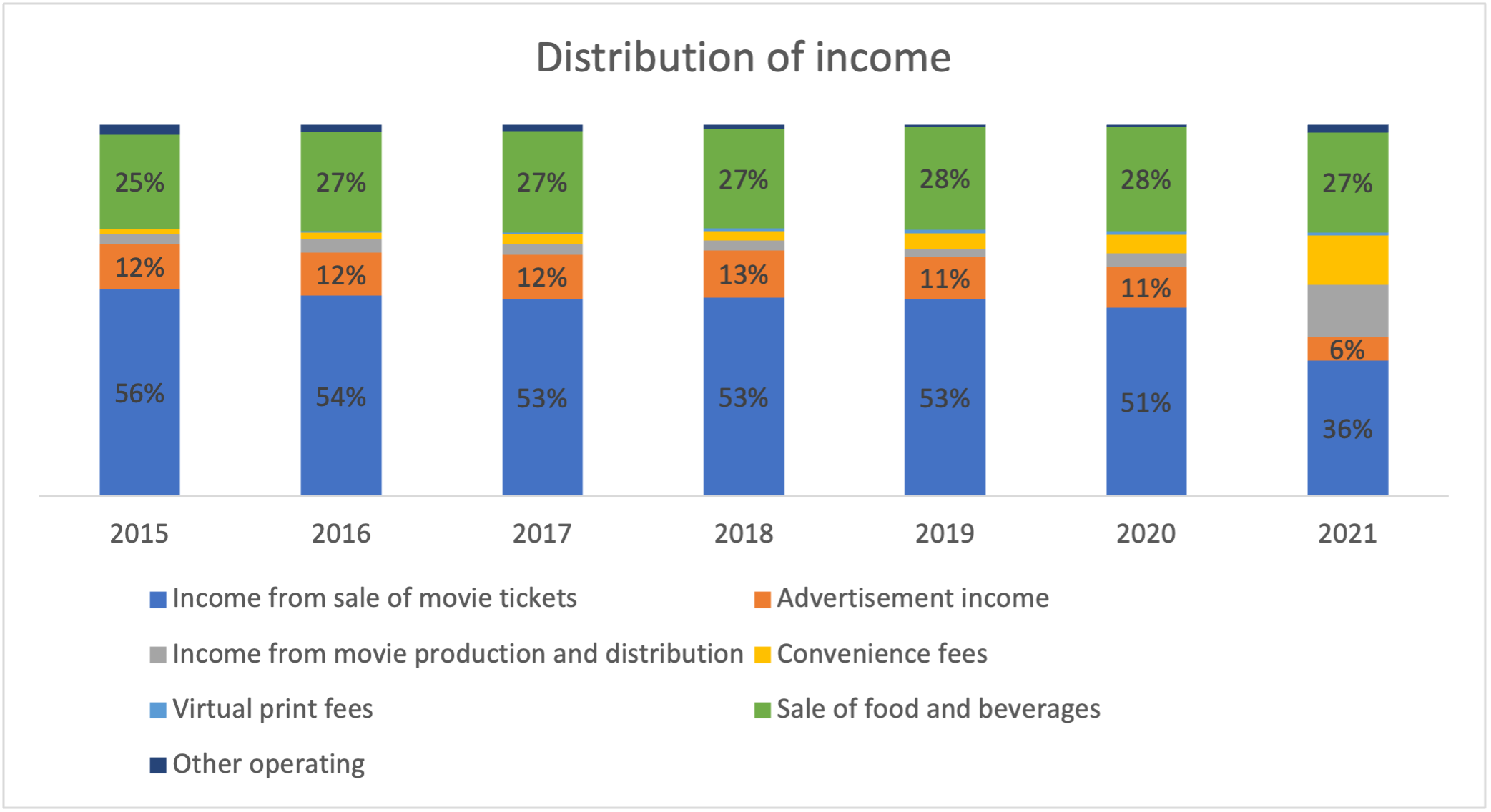

- The primary source of revenue is the sale of movie tickets.

- The second-largest revenue for PVR is the sale of food and beverages.

- Other sources of operating revenue include advertisement income, Income from movie production and distribution, convenience fee, virtual print fee etc.

If we look at the avenues through which PVR cinemas can increase the revenues then there are only two ways.

If we look at the avenues through which PVR cinemas can increase the revenues then there are only two ways.

- Increase the number of tickets sold – this can be done either by increasing more people coming to theatres or increasing the number of theatres.

- An increase per capita can be done by increasing the ticket prices or increasing the overall F&B spend per capita.

However, there are certain limitations:

- The number of theatres can’t be increased randomly – it requires a lot of capital.

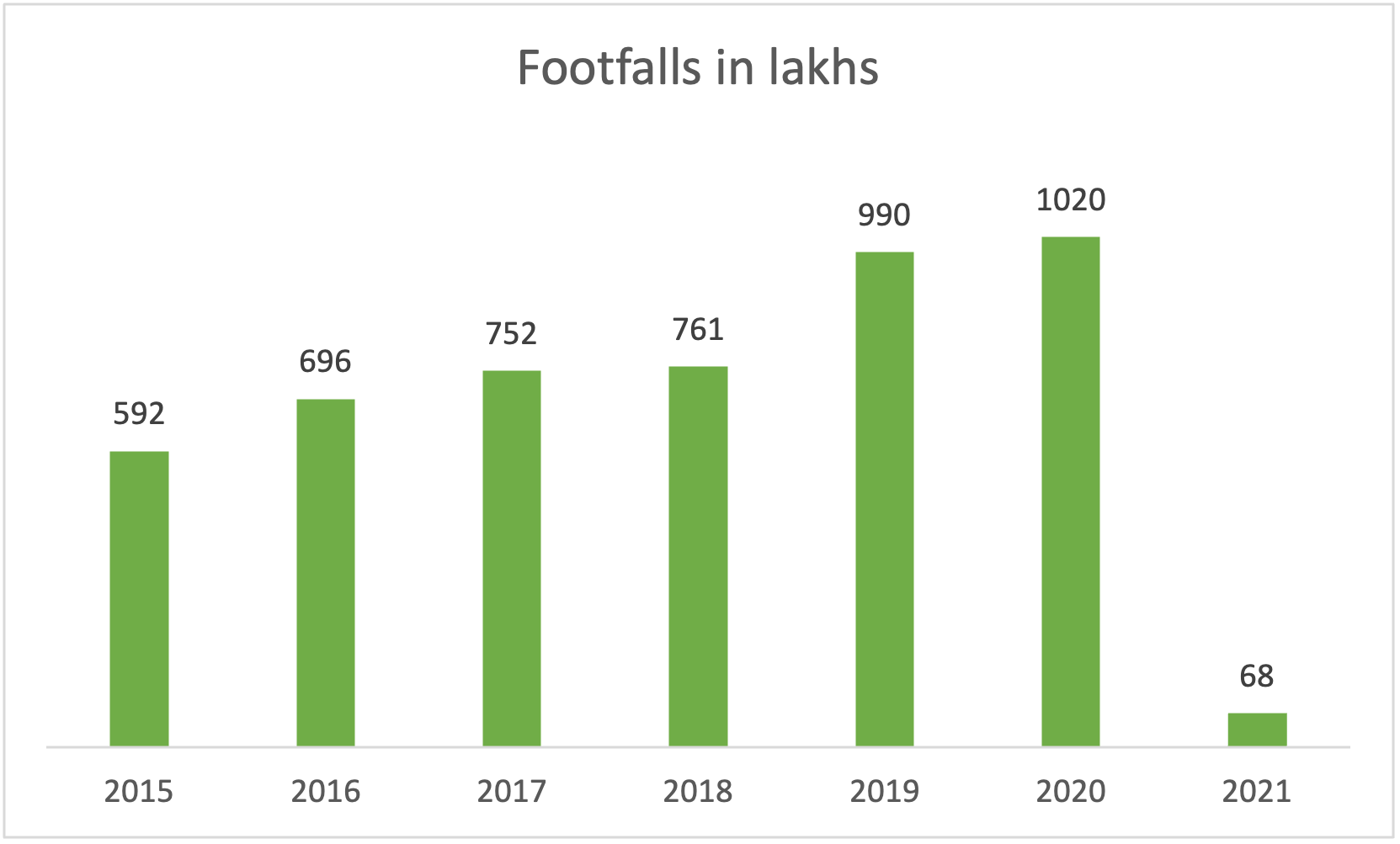

- The number of admissions into theatres is not in the company’s control – it is dependent on the success and the quality of the movie. See the footfalls in lakhs (below graph).

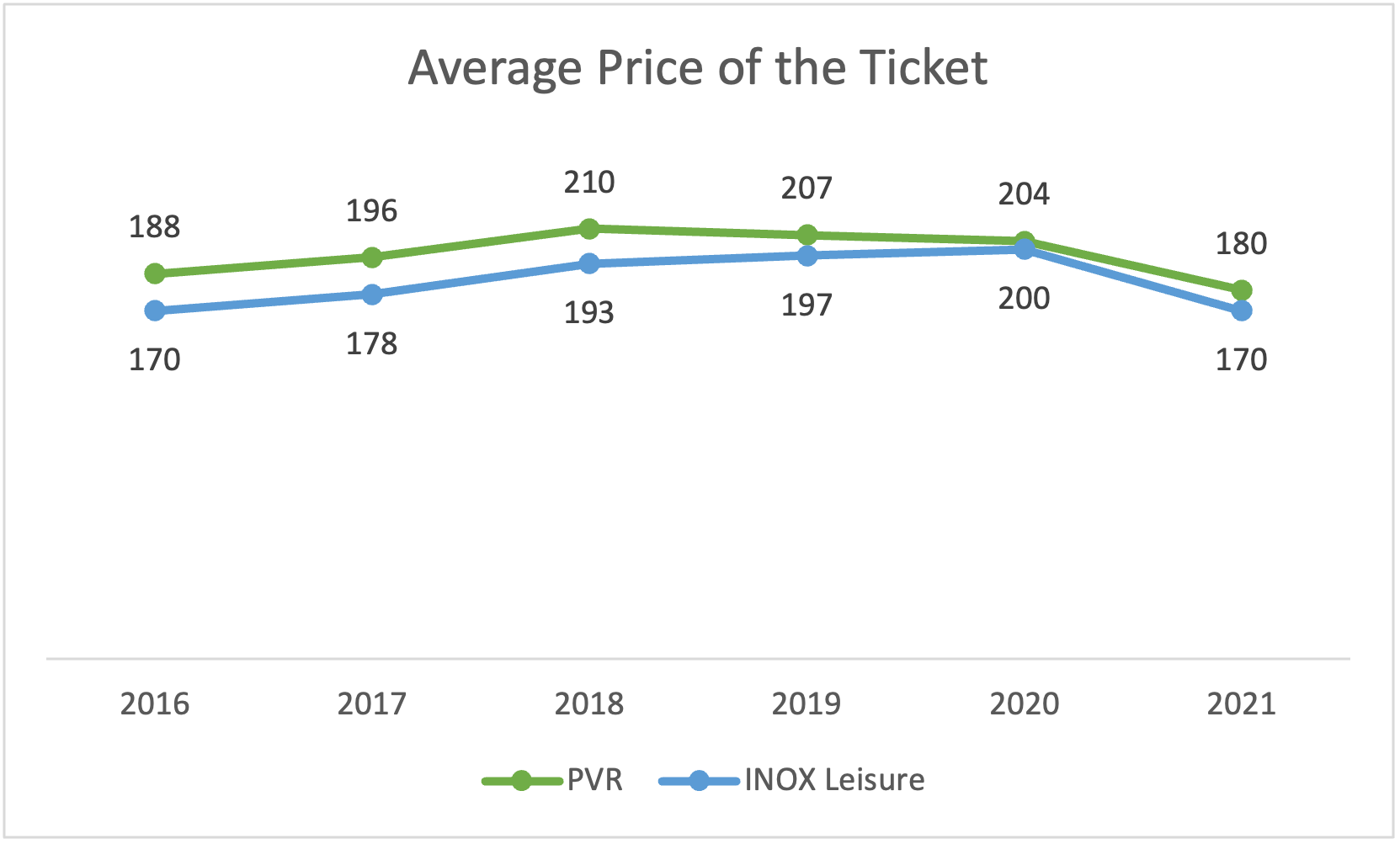

- Prices of the tickets can’t be increased frequently as the customers will find another cheaper option to consume the content. See the per capita price (below graph)

How has Pandemicemic impacted PVR?

How has Pandemicemic impacted PVR?

- In FY 2021, PVR experienced a 93% fall in footfalls; consequently, the revenue fell by 92%.

- The decline in sales has drastically impacted the net profits of the company. The company’s profit fell from 26 crores in FY2020 to a loss of 748 crores in FY2021.

- PVR required greater liquidity to survive. To increase liquidity company decided to raise 1800 Crores in FY 21 through a combination of debt and equity. It raised Rs.1,100 Crores of equity and Rs.700 Crore in debt.

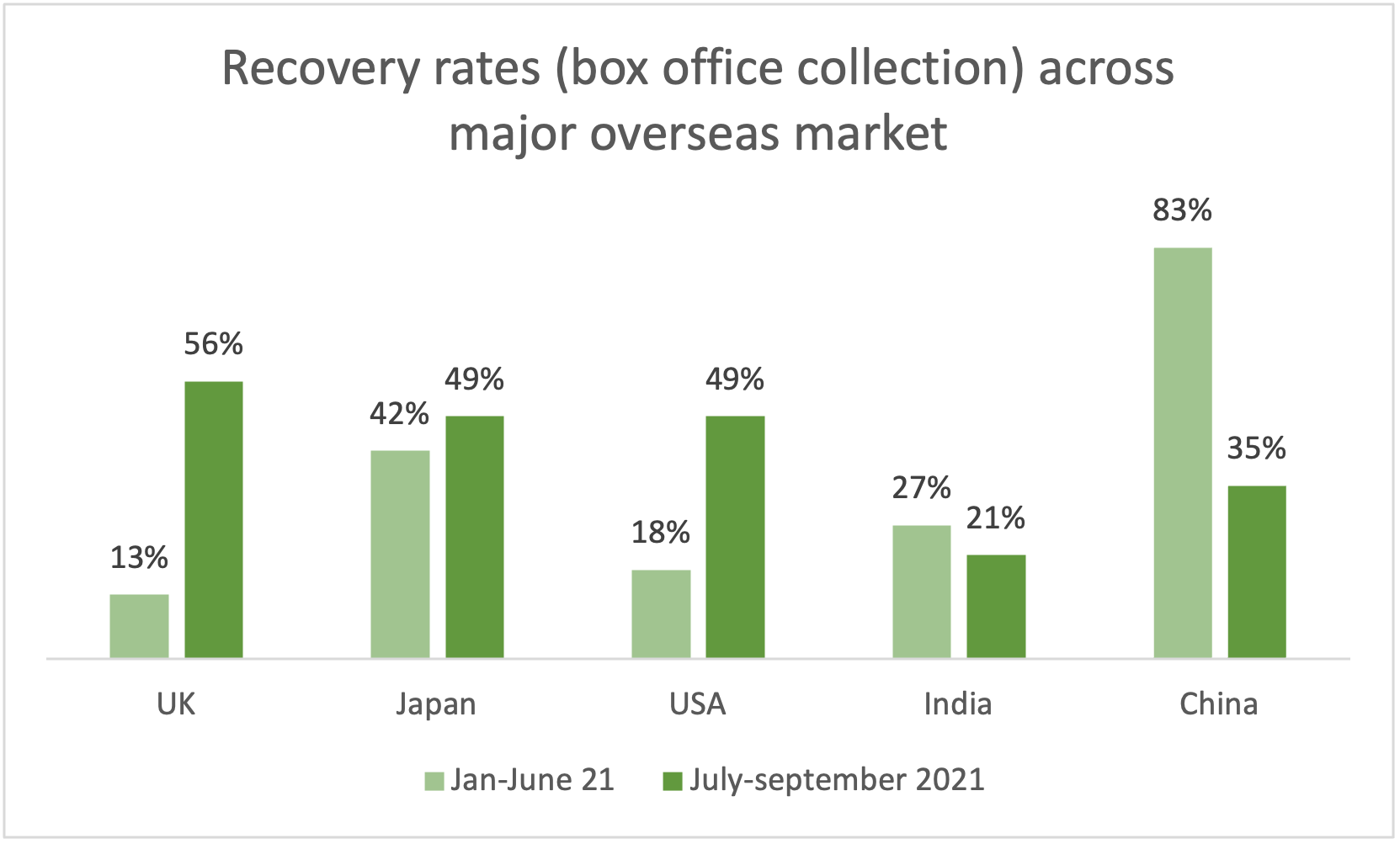

- PVR’s management expects an 85%-90% recovery in the company’s performance by December 2021.

What is the way forward for PVR?

What is the way forward for PVR?

Cost reduction

- PVR obtained whole or partial waivers/ discounts from landlords for the bulk of their properties in FY 2020-21.

- Landlords have extended the rent savings till business returns to normal to mitigate the impact of the 2nd wave of COVID-19. Subsequently, the company’s rent and common area maintenance expenses were reduced by 72% in FY21.

- The company managed to reduce its operating expenses by 73%, from Rs.2,338 crores in FY20 to Rs.615 crores in FY21.

Consolidate

- Single-screen theatres dominate the Indian film industry. Single screens still have an overall 30% of the market.

- 1000+ single screens will close due to financial constraints. This will force the industry to consolidate.

- PVR will likely buy some of the more prominent names on the single screen, but this requires a lot of capital.

- However, consolidation will happen sooner or later because the cost to run single screens is even higher.

Selling F&B beyond theatres

- With this, PVR is trying to utilize the kitchen assets. This will not generate significant revenues but will help them explore new markets.

Diversify beyond movies

- PVR has undertaken to exhibit Live sports and Concerts in its theatres.

- PVR had purchased rights for the public screening of the T20 World Cup. It has proved to be very profitable for PVR.

How will OTT and theatres survive together?

- There is a Direct correlation between OTT and theatres. According to PVR management, people who watch OTT are more likely to visit the theatre.

- The producer also prefers theatres over the OTT platform to release their content.

- Movies released directly on OTT platforms have received poor responses from the audience.

- Further, based on the performance of content in theatres, the producers and distributors can sell it to OTT platforms.

- Higher prices3 given by OTT players to producers are unsustainable

- In September 2021, Disney discontinued simultaneous theatrical and digital releases of movies. All new movie releases in 2021 would go to the theatres first and then to OTT platforms after a window of 45 days or more.

- Industry players expect that the 4-week window in India between theatrical release and release on the OTT platform is a temporary phenomenon. India will revert to an 8-week window once Pandemicemic subsides.

Conclusion

Movie exhibition business is at a juncture where it has the infrastructure ready, demand is reasonably certain but the external factors are affecting the outcome of the business. In what direction it goes and how it innovates to be in the race, is going to be interesting. Watch out for this space.

Story Contributors: Saloni Munshi, Parth Parikh and Terrence Fernandes

Other Trending Posts in this Series – Spotify | HUL | Tesla Valuation

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.