When our FinShiksha team talks to students, we encounter one common question – how to prepare well and fast for CFA Level 1?

Let me take you through the strategy and flow of content for the CFA Level 1 Preparation.

Note: The time duration mentioned to finish a particular reading assumes that you are doing the course for the first time, and you have about 6 months of preparation time.

First and foremost, try and finish the entire portion from CFA Level 1 Official Curriculum – CFA notes are very well written.

(difficulty level on a scale of 1-10 and 10 being the highest)

Kick off the CFA Level 1 Preparation

- Start with Derivatives and Alternative Investments (difficulty level 6). In any case, you should think of starting this first as the questions are quite easy in the exam, and the concepts are different from other subjects, so won’t be any conflict in terms of understanding. This particular section has an overall 10-16% weight. And you should take around 10–12 days to complete this properly.

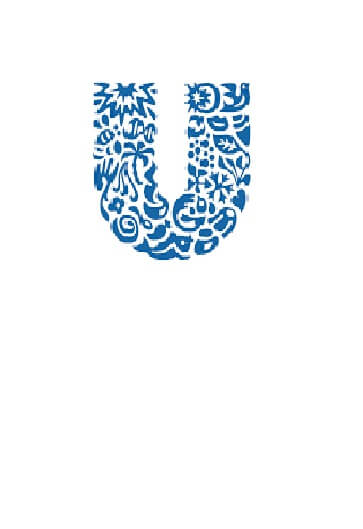

Tackle the Beast now!!!

- Immediately start with FRA (difficulty level 10). Some of the concepts are really complicated when US GAAP and IFRS comes into the picture. This subject is particularly lengthy and boring as you literally have to remember a lot of accounting practices. Also, the weight is 13-17%, so focus heavily on this. You will easily need 20–25 days to finish FRA properly.

Now focus on maximizing the CFA Level 1 Score.

- Start with Quants (difficulty level 8). It would help if you started with Quants since you will need to revise this again when you start solving mock tests. So start and finish this early, so you can revise. Also, some parts related to statistics will appear in portfolio management, so this would help. Quant can actually work against you if you do not prepare well because the weightage is 8-12%, and you will lose marks if not prepared thoroughly. And you should be in a position to finish this in 10 days.

- Immediately start with Corporate Finance, Equity and Portfolio Management (difficulty level 7/7/7). Very practical subjects, easy to understand and easy to score. Nothing to remember here. All concepts. Do it religiously, and you don’t need to study this again. Total weight combining these three would be 23-32%; hence this is as important as FRA but easy to finish, so please do not skip anything here. Also, you will not more than 20 days to finish this.

Now it’s time for some complicated stuff.

- Fixed Income Securities and Economics (difficulty 8 and 9). You decide what you wish to start first. I would suggest that you start with Economics and then Fixed Income. In Economics, you could do the first three readings (easy) and rest towards the end (after doing ethics). And finish Fixed Income similarly (some readings are straightforward). If you decide to do this together, it will take around 20 days to finish both or most of the subject. Combined weight 18-24%.

- Finally, the BOSS of all 🙂 Ethics (difficulty 10 because of the options given in the questions) – Reading won’t take much time here – hardly 2–3 days. What matters here is practice and understanding various situations and scenarios as discussed in the questions. Read CFA Books and pointers thoroughly and then start solving problems, and you will know what to do when (in various situations given). Once you start solving the questions is when you will become comfortable. Weightage is 15-20%, so DO NOT ignore this topic. You will need 7-10 days to finish this.

Finally – Solve Mock Tests for CFA Level 1

Only solve. That’s all. Solve, solve and solve. Solve at least 15-20 full-length mock tests. Find mistakes and revise the concepts.

A score of around 130/180 and in Ethics above 70% accuracy is safe for you to clear CFA L1. (this is a general understanding, CFA Institute doesn’t mention this).

Courses from FinShiksha that should be helpful for a practical exposure on Financial Concepts along with your CFA Preparation:

Certification in Equity Valuation | Certification in Applied Economics | Certification in Applied Financial Statement Analysis

FinShiksha courses complement the CFA study. As you know, the CFA curriculum doesn’t include any company or geography specific examples for Indian students – FinShiksha Courses bridge that gap. We have created all courses which include Indian examples with relevant data.

I hope this helps.

All the best!