Disclaimer: The purpose of this document is purely educational in nature. The idea is to help someone kickstart their analysis of this sector/company. However, this is not to be construed as a recommendation of any sort on the company or its stock. All information has been sourced from publicly available data such as annual reports and news items and the veracity of the sources has not been independently established. Kindly use your judgement while analysing further or using this document.

We would like to applaud the efforts put in by four students from Xavier Institute Management Bhubaneshwar (XIMB) – Anirudha Basak, Manan Gupta, Shobhit Jain and Vaibhav Saith (in alphabetical order) as a part of Live Project with FinShiksha.

Introduction to Retail Industry:

When we generally hear and read about Sales achieved by Companies during “Big Billion Day or Prime Day”, it’s astounding that companies achieve 20 to 30 thousand crores ($3-4 Billion) sales in a span of three days.

It is even more interesting when US and Chinese Companies release figures of their respective sales season, the numbers are just mind-boggling. Just to give you perspective, Alibaba in 2019 did $38 Billion during Singles Day. They did $10 Billion sales in 30 min 🙂 ASTOUNDING!!!

This propelled us to do research on India’s Retail Sector, the opportunities and challenges it throws. Through this article series, we try to give users specific nuances about the retail industry in India. This is part 1 of the series of articles which we will publish in next month or so.

So the question arises, can we know a little about India’s and Global Retail Sector?

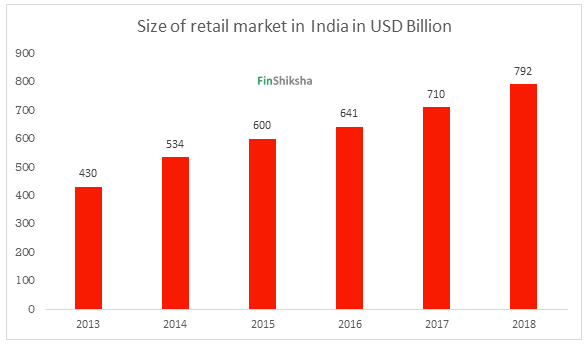

The retail sector contributes about 10% of India’s Gross Domestic Product (GDP) and around 8% of the employment. India is Asia’s third-largest retail market and the world’s fourth-largest after the US ($5.353 Trillion), China ($5.243 Trillion), and Japan ($ 1.3 Trillion). Indian retail sector has grown at CAGR of 12.99% from 2013 to 2018.

Indian retail sector can be broadly divided into Organised and Unorganised Retail.

- Organised Retail is something which requires huge investment, skilled labour and premise size which is relatively huge compared to the Unorganized Retail premises. Generally, retailers have licenses from various authorities under which they can operate and pay taxes to authorities on the sales generated.

- Unorganised Retail refers to the old fashioned – traditional form which is usually situated near a residential area. Unlike Organized Retail, they do not require large premises as they operate from smaller premises which have lesser SKUs to offer to customers. Smaller premise means lower rentals and a lesser number of employees. Conventional Kirana Store is a classic example of Unorganized Retail.

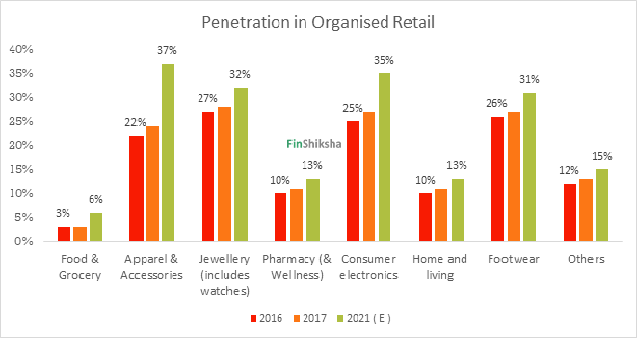

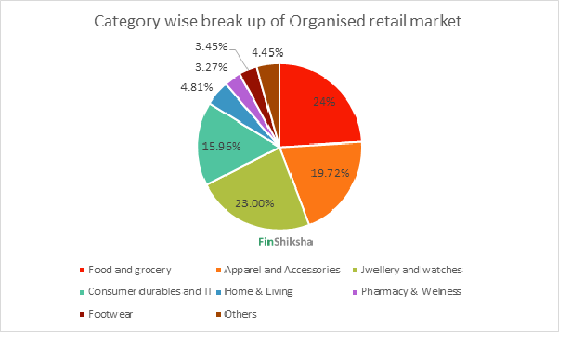

In India, a large chunk of the Retail sector is in the unorganized sector. However, the industry is slowly moving towards an Organized Retail format because of better opportunities and rise of the online medium. The shift is clearly apparent from the below table towards the Organized Retail.

| Year | Type | Total Market Size ($ Bn) | Share ($ Bn) | Share (in %) |

| 2012 | Organised | 398 | 28 | 7.04% |

| Unorganised | 370 | 92.96% | ||

| 2016 | Organised | 616 | 55 | 8.9% |

| Unorganised | 561 | 91.1% | ||

| 2017 | Organised | 710 | 67 | 9.44% |

| Unorganised | 643 | 90.56% | ||

| 2018 | Organised | 792 | 95 | 12% |

| Unorganised | 697 | 88% |

Also, one last point – when the comparison is done in terms of penetration between India and World then India has one of the lowest Organised Retail penetration.

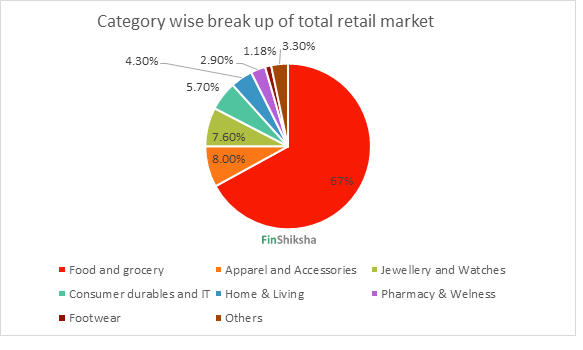

Now, the question comes – Can we have a deeper understanding of categories? Where do people spend?

The food and groceries (F&G) segment constitutes a majority share of the Retail market.

However, food and grocery has relatively lowest penetration in Organized Retail. One of the main reason is the penetration in non-metro cities where people still prefer to purchase groceries from local Kirana Stores.

The market size of the organised food & grocery segment is estimated to register a CAGR growth of 27% from $16 Bn to $41 Bn in the last 5 years.

Some of the key players in each of the sector include:

| Sector | Key players |

| Food & Grocery | Big Bazaar, Easy Day, DMart, Reliance Fresh |

| Apparel | Central, Brand Factory, FBB, Shoppers Stop, Lifestyle, Westside |

| Jewellery (includes watches) | Kalyan Jewellers, Tanishq |

| Pharmacy | Apollo, Medplus |

| Consumer Electronics | Ezone, Samsung, Vijay Sales, Croma, Reliance Digital |

| Footwear | Bata, Khadim, Relaxo |

What are the future prospects of this industry and what are the driving forces behind them?

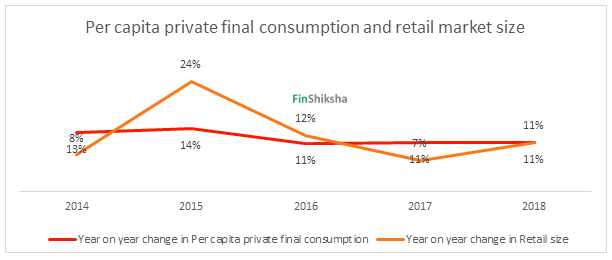

- Increase in Private Final Consumption per Capita – The growth in the size of the retail market has been in line with growth in per capita private final consumption. The expectation is that the Private Final Consumption Expenditure to grow by about 10-11% YoY for the next decade. (Source: CARE 2019)

- Women entering the workforce – This will lead to a huge spike in demand. In the last 5 years, from FY 2014 to FY 2019, women workforce in India has increased from 5 million to 7 million and is expected to reach 10 million by FY 2024. That’s HUGE. Spending propensity of working women is higher by 1.3x as compared to Indian housewives since they have more disposable income and gives rise to higher discretionary spending. (Below chart is as per Census 2011 Data)

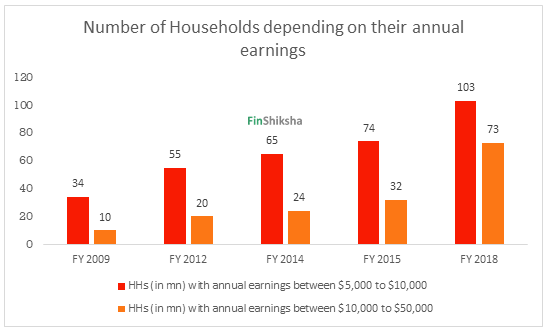

- Middle-income households – Households with annual earnings of between Rs. 3Lakhs and Rs. 6Lakhs per year (USD5,000-10,000 at an exchange rate of $1 = Rs. 70) has grown at a CAGR of 17% over last 5 years and are projected to reach 30 Mn+ households in FY20. Households with annual earnings of Rs. 6Lakhs and Rs. 35Lakhs per year (USD10,000-50,000 at an exchange rate of $1 = Rs. 70) has also grown at a CAGR of 20% over the last five years. Increase in the number of households with higher earnings will lead to an increase in discretionary spending.

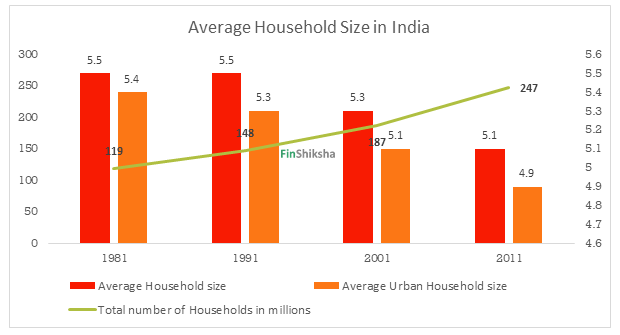

- Fall in the average household size – Because of urbanization and nuclear family concept, there’s an apparent fall in average household size. This coupled with rising disposable income is likely to lead to a higher percentage of discretionary spending. About 74% of urban households have five or fewer members according to the census data in 2011 compared to 65% in 2001. The per capita consumption increased in the case of a nuclear family.

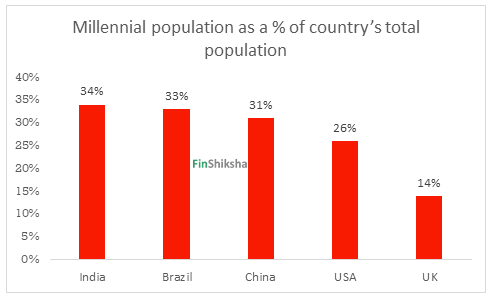

- Millennial population – With the median age of 27 years (solid advantage and India will continue to lead the world in terms of avg population age for next decade or so), India is home to world’s largest Millennial population. With 440 million of them, they make 34% of the total population in India. Further, their contribution to the Indian workforce is significantly higher at nearly 48% in FY 2019. In terms of sheer size and this young segment is the major driver of consumption as they have the ability (disposable income) and willingness to spend.

This is all fine, any Impact from Online Retail?

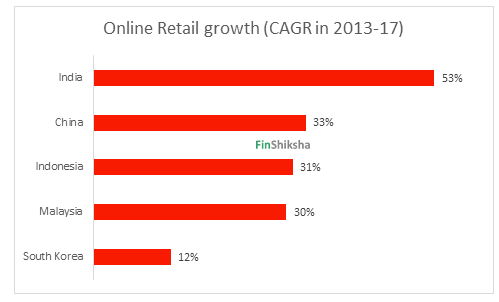

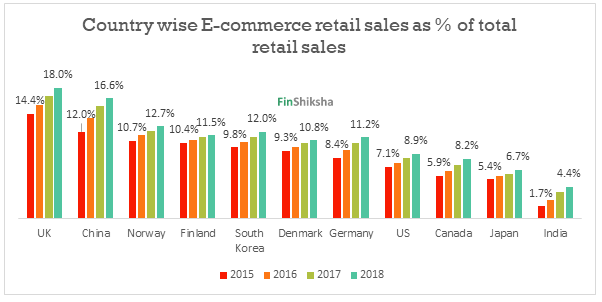

- India’s e-commerce is one of the fastest-growing channels for commercial transactions. E-commerce in India is growing at an annual rate of 53%, the highest in the world. Still, India has one of the lowest e-commerce retail sales as a percentage of total retail sales when compared to other countries. That itself is very promising when we see the future. No wonder why everyone wants to Invest in India 🙂

E-tail in India can be broadly categorized as:

- Based on the location:

- Domestic: sale within India. This is largely B2C sales. Example: Amazon, eBay, Flipkart, Snapdeal, Shoppers-Stop, Reliance, Croma

- Cross-Border: sale in India from outside India. The U.S. is one of the top ten countries for cross-border shopping for Indian buyers. Baby supplies, toys, footwear, wearables, personal accessories, jewellery, watches, digital entertainment and educational services are some of the leading categories for cross-border sales. Example: eBay, Alibaba

- Based on Model followed:

- Inventory-led: The e-tailer stocks products and sells directly to the consumer. Here inventory needs to be stored which is a huge cost. Example DMart selling products through own app

- Managed marketplace: The e-tailer is a listing platform for the seller, but the logistics, product quality and packaging are managed/controlled by the e-tailer to maintain quality and delivery standards. Example: Amazon, Flipkart

- Pure marketplace: The e-tailer is only a listing platform for sellers. The logistics are managed by the sellers. Example: Naaptol

- Based on Number of brands:

- Single brand: Company owns and sells goods online under a single brand eg. Sony, Nike, Adidas, etc.

- Multi-brand: E-commerce players that sell goods of more than one brand on their websites eg: – Shoppers Stop, Big Bazaar, etc

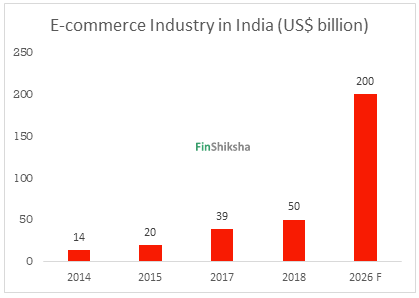

The Indian e-commerce market is expected to grow to US$ 200 billion by 2026 from US$ 50 billion as of 2018.

The important driving factors of online retail are:

Growing internet penetration

- Rising internet penetration is expected to lead to growth in e-commerce. The internet penetration is expected to rise from 39.3% in 2018 to 59% in 2021.

- Penetration is yet to be achieved in rural areas. India’s internet penetration in the urban areas stood at 82.1% and 19.5% in rural areas. Approximately 75% of the new internet users are expected to come from rural regions because they have easy access to internet and data thanks to Jio 🙂

- The number of active internet users in the country is the second highest globally and data usage of 10 GB per subscriber per month is comparable to developed countries. (Source: Hotstar India Watch 2019 Report)

The rising number of online shoppers

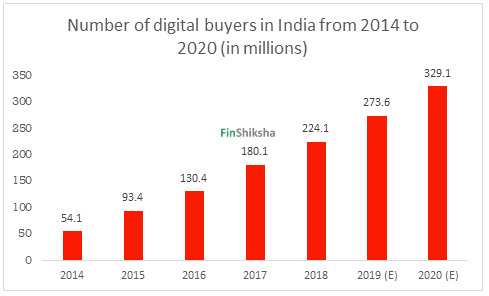

The number of digital buyers across the country was estimated to be approximately 330 million in 2020. The figure suggests that almost 71% of internet users in the region will have purchased the product online for the mentioned time period.

Increasing usage of smartphones

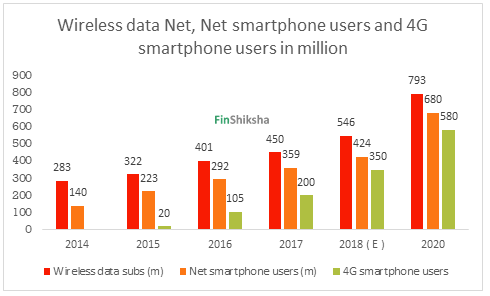

Smartphone users in India are expected to increase from 359 million in 2017 to around 680 million by 2020, which is also likely to drive the mobile commerce sales from $10.5 billion in 2016 to $38 billion in 2020.

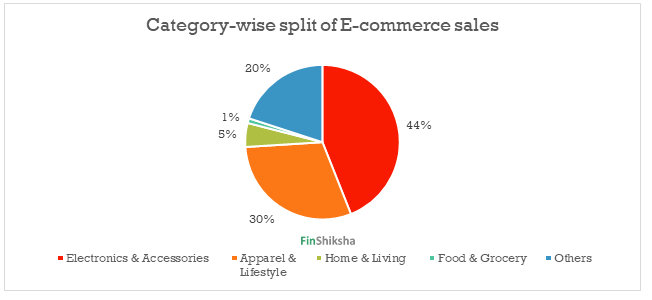

Category-wise split of E-commerce sales:

- Consumer Electronics constitutes the major portion of e-tail in India, being a highly standardized category. This is followed by Apparel and Lifestyle. Think of Xiomi Flash Sale. I am sure that everyone has experienced it at least once that how fast the mobile phone sale happen. BIG SHIFT!!!

- It is important to note that Food & Grocery E-tail penetration is near zero. This mainly happens due to different category dynamics. For example, Food & Grocery requires high logistics cost and efficient inventory management. However, everyone is trying to enter into this space as this drives volume and multiple purchases happen.

Numbers look FASCINATING!!! Could you tell us about India’s Landscape?

Major Retail Players in India:

| Listed Company | Key Stores/Brands | Presence | No. of stores | Revenue(in crore rupees in 2019) |

| Avenue Supermarts Ltd. | D-mart | Presence in 11 states and 1 U.T. Highest presence in Maharastra and Gujarat. | 176 | 19,916 |

| Future Retail Ltd. | Big Bazaar, Easy Day, Heritage Fresh, 7- Eleven, WH Smith, Brand Factory, Central, Brand Factory, Central, FBB, Food Bazaar, Food Hall, Hometown | Presence in 428 cities with the aim of being within 2 KMs of every urban household | 1511 | 20,165 |

| Trent Ltd. | Westside, Zudio, Star, Landmark | Westside- 82 cities, Zudio- 12 cities, Star- 5 cities, Landmark- 5 cities | 204 | 2,109 |

| V-Mart Retail Ltd. | Vmart | 170 towns in 17 states with highest in Uttar Pradesh, Bihar and Jharkhand. | 214 | 1,439 |

| Arvind Fashions Ltd. |

Flying Machine, Arrow, US Polo, Izod, Elle, Cherokee |

Over 192 cities and towns across India | 1,300 standalone stores and about 5,000 departmental and multi-brand stores | 7,226 |

| Spencer’s Retail Ltd. | Spencer’s, 2Bme, Smart Choice, Trusted Value, Care & Essentials, Clean Home and Besser. | Presence in 33 cities in India. The Company has selected to deepen its presence in North, East and South India.

|

156 | 2,214 |

| Osia Hyper Retail. | Osia Hypermarket | Presence in Gujarat in cities like Ahmedabad, Baroda, Gandhinagar, Gandhidham, Dehgam | 13 | 231 |

| Reliance retail (part of reliance industry) | Reliance Fresh, Reliance Smart, Reliance Market, Reliance Digital, Jio Store, Reliance Trends, Project Eve, Reliance footprints, Reliance Jewels, Reliance Mall | Presence pan India with the highest number of stores | 10644 | 1,30,566 |

In the next part, we will continue our discussion on the key industry drivers and business metrics for individual companies.