Note: The purpose of this document is purely educational in nature. The idea is to help someone evaluate the mentioned company. However, this is not to be construed as a recommendation of any sort on the company or its stock. All information has been sourced from publicly available data such as DRHP and Final Prospectus. Kindly use your judgement while analysing further or using this document.

SBI Cards IPO Offering is a significant event for a reason – it is a one of its kind within the financial services ecosystem in India that generates revenue only through credit cards and now offering equity to the general public. And this is happening for the first time in India. Even globally we do not have any player who just generates revenues from cards.

Someone can argue about American Express but there’s a big difference between Amex and SBI Cards which is the network which Amex has. Amex issues its own cards and they generate revenue from merchants as well like Visa and Mastercard. So yes, Amex is a comparison with respect to cards but not a close comparison.

Coming back to this post, through this we will try and give you information about the Industry/Company and the rationale behind the same.

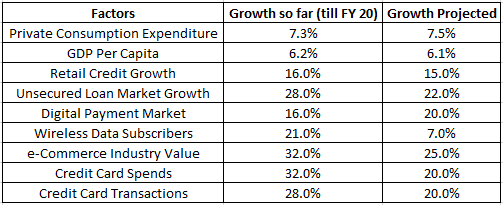

First things first, what is the state of payments industry in India and what is the scope?

Considering the data provided in below table and considering the population of India, digital payments will surely grow faster in the entire payments ecosystem. We have seen already that with UPI based interfaces like Google Pay, PhonePe etc.

However, the question still remains that will all the above factors increase the credit card spend and do we have any history around the same?

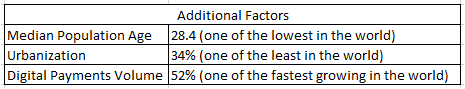

So, we look at the players in the industry to get some interesting insights.

- All companies have grown their card portfolio business – so there seems to be a demand for the credit cards.

- India has close to 50Mn credit cards in force (which is 4% of the population). However, this may not be correct because one person can have multiple credit cards. So the number of unique cardholders must be around 2-3 crore considering a person have 2-3 credit cards on an average (so that comes to 2% of the population having credit cards). So the opportunity size is huge.

- Top 5 issuers control 78% of the market.

- The number of transactions growing at a faster pace compared to cards issues, which shows that people are transacting more number of times per card.

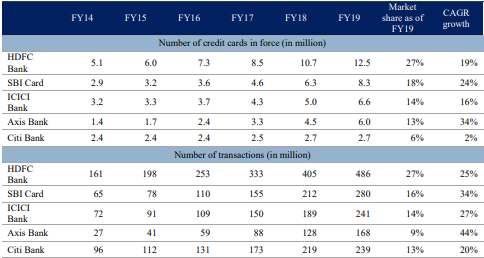

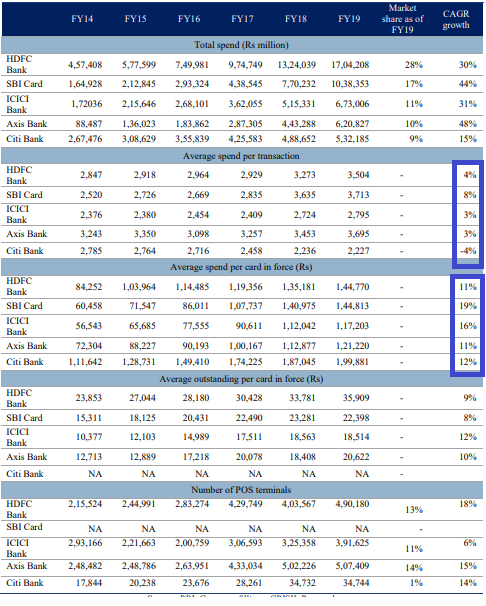

Now comes the interesting table:

- The previous table gave us the idea that cards are being issued at a faster pace and transactions are being done which is good.

- However, the average spend per transaction and average spend per card is not increasing at a faster pace.

This means till the time the cards are being issued to a fresh customer, there will be growth. Because if spend per card is not increasing then the outstanding per card will also not increase which means interest income per consumer will not increase and hence overall profitability per person for the company will not increase substantially. So as of now, only major growth driver is card issuance.

Now the important question, how is SBI Cards placed?

Will come to financials in the latter part of this post. But before that, let’s understand some finer nuances on the SBI Cards growth aspects.

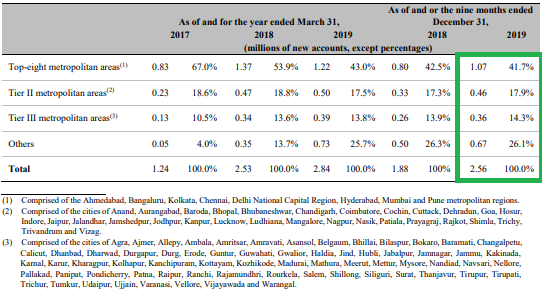

- Target Audience: SBI Cards seems to be targetting Tier 4 cities as the 26% of the new accounts added were from that segment. Data suggests that they have changed their strategy to source more clients for faster growth. The problem, however, is the cardholder may not be that profitable if you source from tier 4 cluster onwards because of the mindset of not keeping too much of credit/loans.

- Revenue Generation: Of Total Revenue, the company generates 51% from Interest Fees, 49% from Other Fees like MDR, Late Fee Charges and Card Fees.

Now, here’s the thing. Why more cardholders matter?

More the cardholders –> larger pool of cardholders generating revenue by not paying on time –> more interest income and late fees

More the cardholders –> more transactions –> more Merchant Discount Rate (MDR) and Card Annual Fee

However, here are the potential issues.

Issue 1: Newer Cardholders for SBI are coming from Tier 2/3/4 cities and they may not use the card for many transactions, and even if they do, they will usually pay everything on time. Interest fee thus may be unlikely to grow at 30-40% on a longer-term basis.

Issue 2: There was a statement by RBI to remove MDR on Debit Cards (issued by RuPay) to facilitate the more digital transactions. Unlikely that will happen for Credit Cards but there can be some policy changes. And this will affect the revenues.

The question here: Why MDR removal is unlikely for Credit Cards? When the card is swiped, then Visa and Mastercard do the job to approve the transaction for card issuer and merchant both. So they charge a fee. Basically, money transfer needs to be handled. But with an intention to encourage digital transactions, the RBI said that no MDR will be charged for UPI and RuPay cards. Also in UPI, the money transfer happens directly so there’s not much of handling (this is a problem too, query resolution is a problem with UPI – what if money is not deposited but deducted from the account)

But with credit cards, the entire cycle is of 45 days so unlikely that MDR will go away from Credit Cards at least in foreseeable future.

How is the company financially doing?

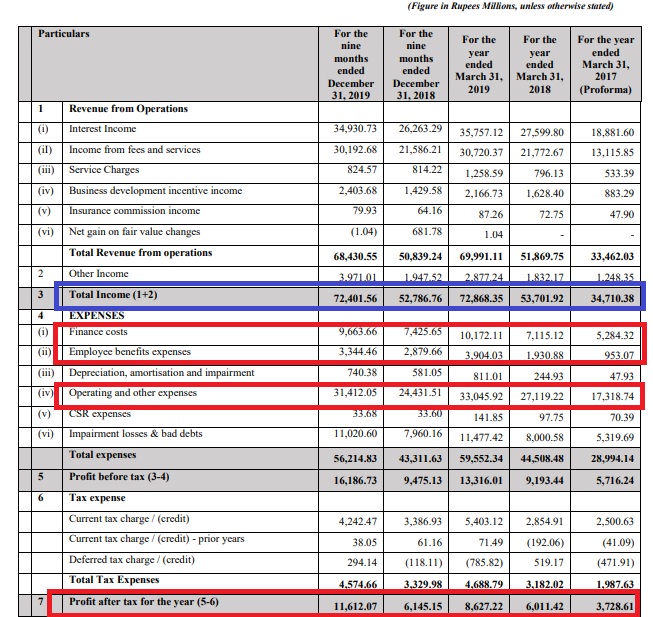

The financials show that the company has shown tremendous growth over the past couple of years. (all growth figures between 2017 and 2019). Company reported –

- Revenue growth CAGR of ~45%

- PAT growth CAGR of ~52%

However, the aggressive growth has also increased some of the costs like –

- Employee benefits expense which grew at a CAGR of ~100%

- Rest of the other expenses have shown CAGR of ~45%

So, it is safe to infer that growth seems to be fuelled because of aggressive selling. Most likely scenario.

Valuation and Comparison

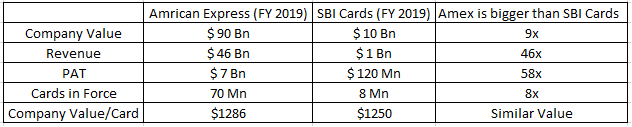

SBI Cards is offering ~14 Crores Shares (~14.5%) at a price range of Rs. 750-755 so that comes to around Rs. 10,570 Crores. That means the total valuation comes to Rs. 70,000 ($10 Bn). How does it fare compared to the closest player?

As we discussed, the closest player is American Express and the comparison is a below:

We can see that in all aspects Amex is bigger than SBI Cards and naturally that’s what we have expected. However, Company Value/Card is almost similar and that’s the surprising part. Amex has premium cards, operates in many countries, has high spending customers, has its own network but when it comes to SBI Cards, they only have cards for now. So the value premium they seem to be getting is due to the growth and opportunity size of Indian markets. How fast the company can grow, time will tell, but they do have a huge scope of growth.

To reiterate, this is not a reco to buy or sell this stock. We have presented information around the company, and would love to hear your thoughts on this as well.

Post image is taken from official SBI Card website.