Disclaimer: This post is purely for an academic understanding perspective. This is NOT a recommendation to buy or sell any securities. Also, the post may pick snippets of news articles, and the idea of that is not to offend/demean anyone. Commodities are seriously difficult segments to evaluate / invest in – so only sharing our learnings.

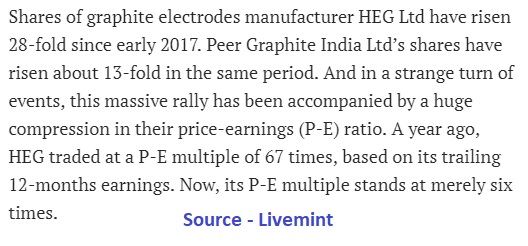

Recently, we had been looking at the charts of two stocks HEG limited and Graphite India, and were intrigued by how they have fared in the last 3 years

Both stocks went up 10-20 times between the beginning of 2017 and end of 2018, and since then have corrected nearly 80% from the respective tops.

Let’s first understand why they went up. Basically, both are producers of graphite, and graphite is used in the electric arc furnace (EAF) method of producing steel. Steel production shifted to EAF in China once China banned the more polluting Blast Furnace Method in the wake of rising pollution. A detailed and beautiful explanation of the same is done here, by Deepak Shenoy at Capitalmind – https://capitalmind.in/2017/11/story-pollution-china-caused-3x-increase-graphite-electrode-profits-year/

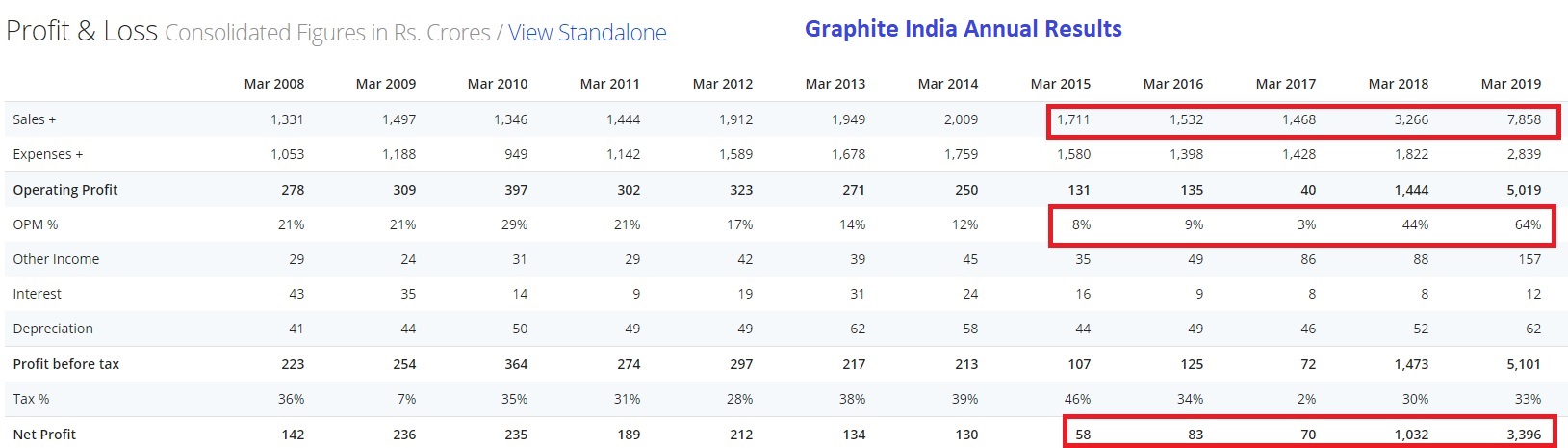

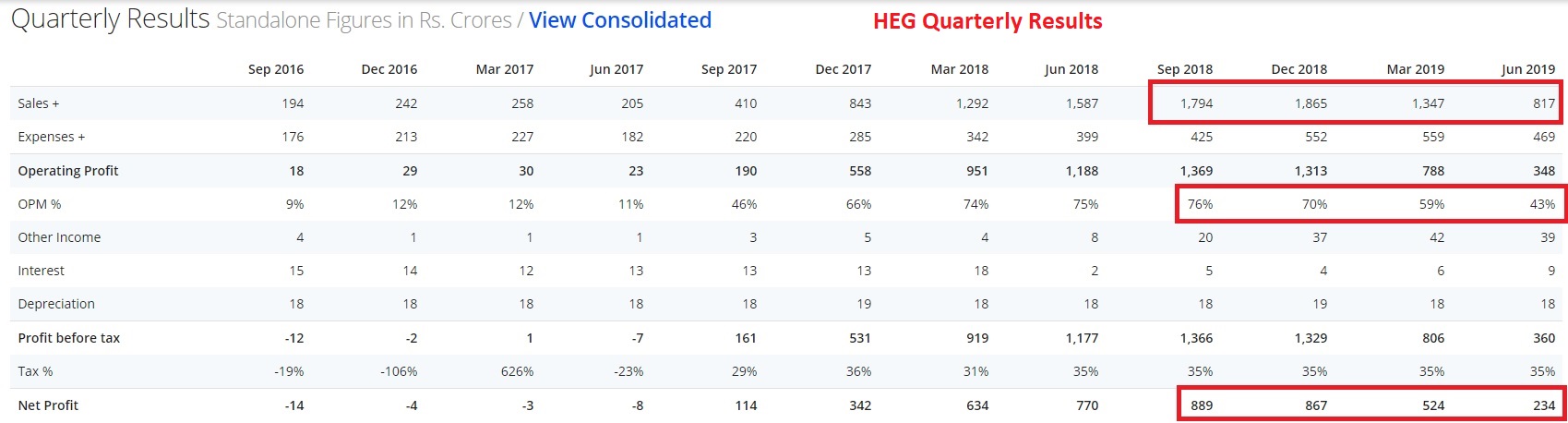

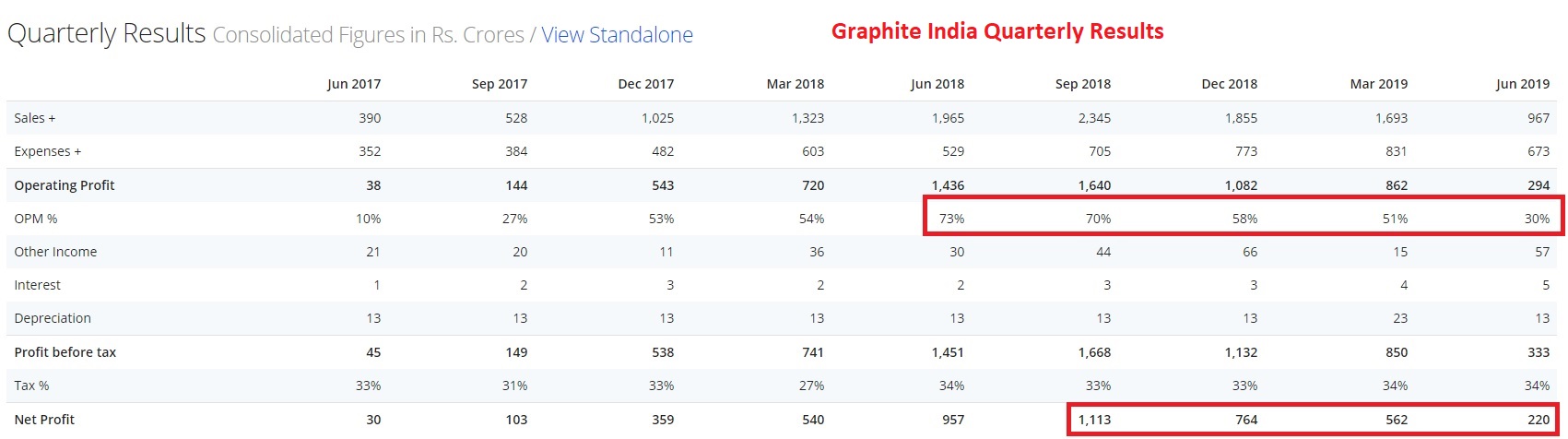

Now once graphite prices started moving up, so did profitability of these companies, and margins along with that. Share prices followed suit.

However, when you invest in commodities, you remember one thing – the CYCLE. The cycle always turns, and no matter how good you are, no matter how much money you have made in the markets, commodity cycles will confound you. Let’s see how.

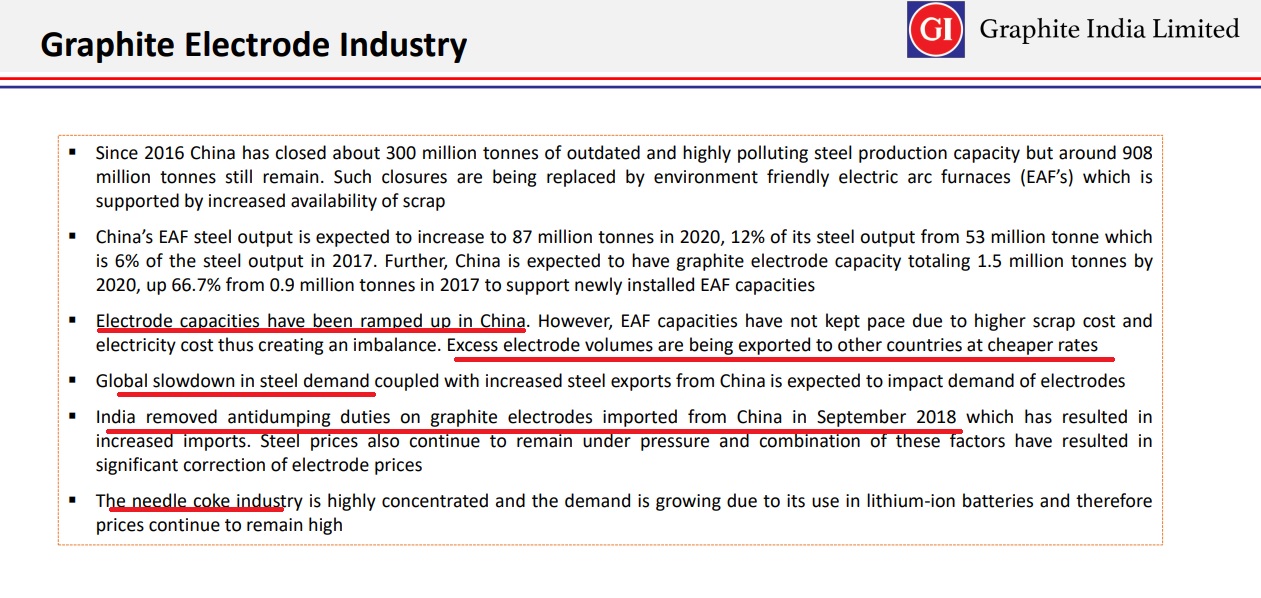

Commodities work in cycles. So as the cycle turns upwards, more capacity comes on stream, and that increases the supply, which then results in prices falling down, and turning the cycle down, which then results in capacity closure, falling supply, and rising prices. The whole thing basically keeps repeating itself.

This is what has happened in the graphite industry in the recent past (from Graphite India Investor Presentation)

And these are the last few quarter results of Graphite companies. Clearly the impact of falling graphite prices has been seen in the numbers

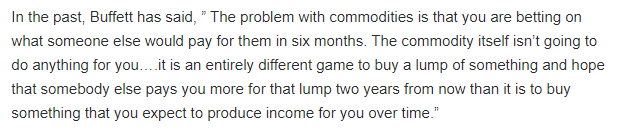

It is this turn in cycle that makes valuation of commodity stocks very difficult. When you use valuation tools, they are difficult to apply, Try DCF – what would be the prices of steel or graphite you would put in next year, or the year after that? This is what Warren Buffett has said about commodities.

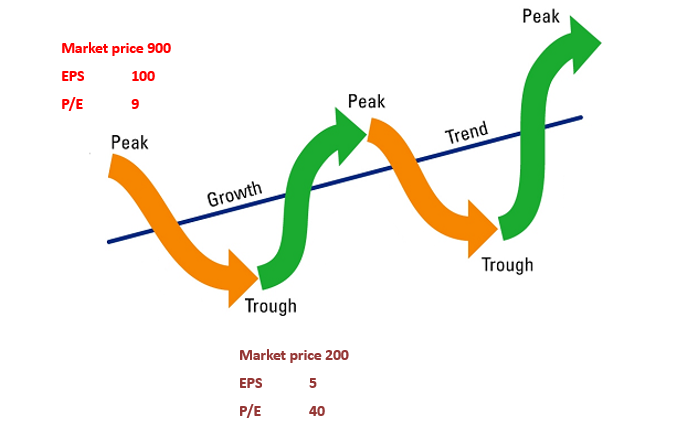

Let’s try relative valuation – See what happens to the cycle and earnings. As markets peak, earning jump, and the P/E appears lower. When cycle turns, earnings dip dramatically, so P/E appears higher. Makes you buy the stock at cycle highs and sell at cycle lows. An example here – see what is the P/E at cycle top and cycle bottom.

At cycle tops, news like this appears to confuse us

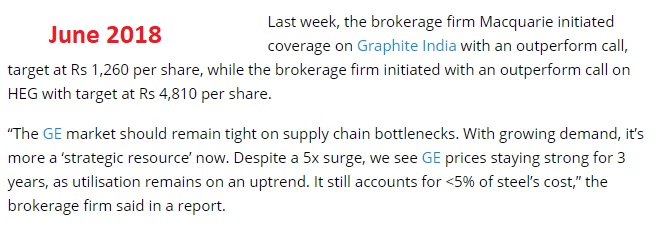

Then of course, a lot of the people miss this rally, and try ways to get in this game. Reports start justifying why these companies will continue to do well, or how they become “strategic resources” from being just commodities. Not a good idea. A commodity may be a strategic resource. But it’s a commodity first.

Another one

What we tend to forget is that commodity cycles will turn, and when they do, the arguments of commodities being “strategic resources” or them giving high dividend pay-outs all vanish. And once the cycle turns, the carnage begins.

So when investing in commodities, or evaluating these stocks, you follow some basic rules

- You buy commodity stocks when nobody is interested in them and hope that the cycle turns in near future. The keyword is hope – since nobody has ever been able to time a commodity cycle turn, and if you get it wrong, you could lose all your money. So if you don’t like this possibility, stay away from commodities. In any case, do not load your portfolio with commodity stocks – ever.

- Find a sector and stock that is beaten down, companies most likely making losses, and there should be some light at the end of the tunnel. Think of the reasons why the scenario could change

- If you jump in after the price has moved, the task becomes difficult, since risk reward as become unfavourable. Remember, commodity prices move in cycles, so commodity stocks are almost never buy and hold stories.

- You don’t buy a commodity stock when it has just made a top and is correcting like a falling knife. You only get hurt in the process. The argument of how much it can fall is irrelevant, like we have seen in Graphite and HEG.

Does that mean it is time to buy some of these stocks – we don’t know. Maybe some of them have bottomed in certain sectors, but till the time they don’t stop falling, and stabilize at some levels where there is very little investor or trader interest, usually these stocks don’t bottom. So don’t treat this as an advice to buy or sell these stocks. Please do your own research. And never chase a commodity stock that is running up. You may get lucky, but when it turns, the picture is never rosy. When you evaluate these stocks, from the purpose of equity research, or credit research, always keep in mind the impact of a cycle turning on the company’s financials and numbers.

Sources : The images have been collated from news articles and the financials from screener.in. Images of charts are from investing.com