Disclaimer: The purpose of this document is purely educational in nature. The idea is to help someone kick-start their analysis of this sector/company. However, this is not to be construed as a recommendation of any sort on the company or its stock. All information has been sourced from publicly available data such as annual reports and news items and the veracity of the sources has not been independently established. Kindly use your judgement while analysing further or using this document.

In the second part of our series on the Aviation Sector, we tried to answer some specific questions like why people invest in Airline? Why companies lease and Aircraft? You can access the second article of the series here – FinShiksha Sector Insights – Airline Sector in India – Part 2

In the first part of our series on the Aviation Sector, we went through important various numbers and parameters on which Airline Industry can be assessed like RPK, ASK, PLF etc. You can access the first article of the series here – FinShiksha Sector Insights – Airline Sector in India – Part 1

In this Article, we will ask the final set of questions related to potential risks and growth opportunities

Do ATF prices move along with Brent Crude prices – How does it Impact EBIT Margins?

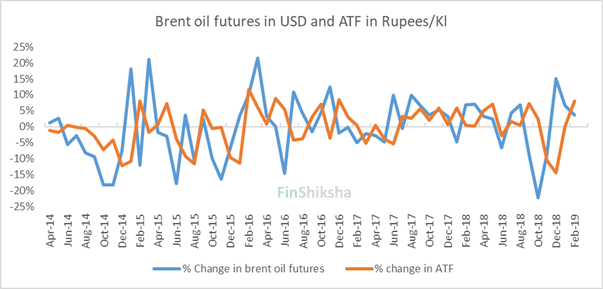

- When we compare Brent oil futures with Aviation Turbine Fuel (ATF), the ATF moves with a lag to Brent oil futures.

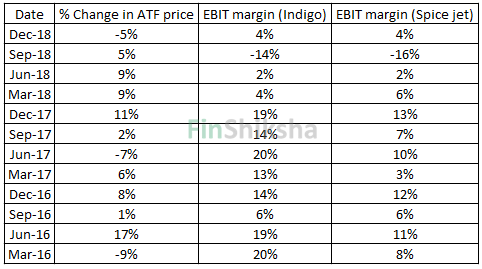

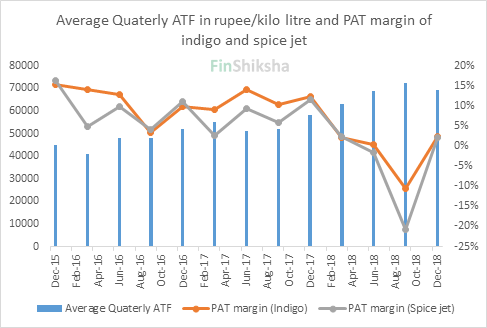

- Historically, there has been an inverse relationship between fuel cost and operating margins of an airline.

- However, the relationship is not exact, since several factors introduce distortions. These include fuel hedging, currency movements, and long-term improvements in the fuel efficiency of aircraft engines and airline operational processes.

- Sometimes the favourable supply/demand allows the airlines to recover increased fuel costs from customers through fuel surcharges during that period thus the impact of rising in fuel cost on profitability is reduced.

- In 2017-18 the average cost of ATF increased from Rs 50,000 per kilolitre in 2016-17 to Rs 55,277 per kilolitre in 2017-18. Despite an increase in the prices of ATF, the EBITDA margin of Indigo improved from 15.8% in 2016-17 to 17% in 2017-18. This was primarily due to an increase in Revenue per available seat kilometres by 6.5%.

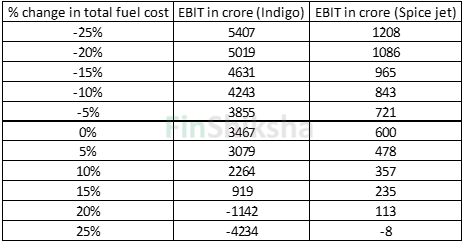

- From the above table, we can conclude that the cost of fuel has a significant impact on EBIT. To analyse the amount of impact fuel prices have on margins, we can conduct sensitivity analysis.

- Assuming everything else remains constant when IndiGo’s fuel cost increases above 20%, it will start incurring losses and Spicejet will start incurring losses if its fuel cost rises above 25%.

Where does India stand globally?

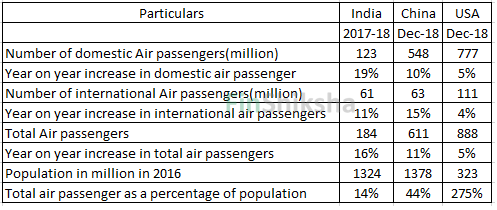

- India has risen to be the third largest air travel market in terms of domestic passenger traffic in 2016, behind only the United States and China and ahead of Japan, according to Centre for Asia Pacific Aviation India Private Limited (CAPA).

- In order to understand the growth potential of the Indian aviation market, we can compare the Indian aviation market with China.

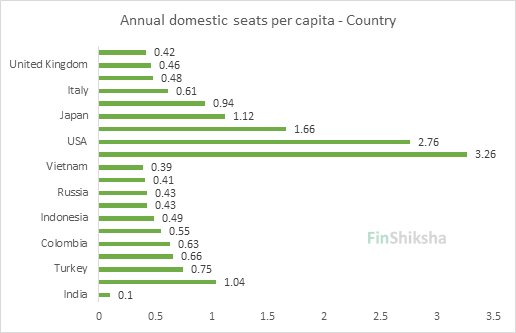

- Air travel penetration in India is the lowest when compared to China and the USA. The air travellers to population ratio is only at 14% in 2017-18. In fact, India has one of the lowest air travel penetration rates in the world, as defined by annual domestic carrier seats per capita, according to CAPA.

Source: IndiGo DRHP 2017

What is the Government Doing? Does UDAN (Ude Desh ka Aam Naagrik) Scheme Affect?

- UDAN RCS (Regional Connectivity Scheme) was launched in October 2016 to develop the regional aviation market. It aims to make flying affordable by providing connectivity to un-served and under-served airports of the country through revival of existing airstrips and airports so that persons in regional towns are able to take affordable flights.

- Applicable on flights covering the distance between 200 km and 800 km with no lower limit set for hilly, remote, island and security sensitive region. It seeks to reserve a minimum number of UDAN seats i.e. seats at subsidized rates and also cap fare for short distance flights.

- For the fixed-wing aircraft, there is a cap of maximum fare of INR 2500 per hour of flight for the 50% of the seats (min 9 RCS seats and max 40 RCS seats per fixed-wing flight), connecting unserved and underserved regional airports and remaining 50% seats will be priced at market rate. Capped RCS fares will also be graded based on distance, e.g. INR 1,420 for a distance of 151–175 km, INR 1,500 for a distance of 176–200 km, and so on, with a ceiling of maximum INR 3,500 fare for a total distance of 800 km or more.

- In the first round of bidding 5 airlines won 128 routes connecting 43 airports while 325 routes were awarded to 15 airlines in the second round in January 2018.

- The total subsidy outlay under the first phase of the UDAN scheme was Rs 214 crore per annum, which increased to Rs 500 crore annually under the second phase. The aviation ministry had also sought Rs 200 crore to fund the second phase of the scheme. Under the third phase of UDAN, the government has announced international as well as seaplanes operations and the subsidy outlay is estimated to go up to Rs 1,250 crore.

- RCS is highly profitable for a 48 and 78 seater aircraft operator. (A document prepared by FICCI and KPMG advisory service private limited provides financial viability assessment of RCS operations.)

- Under this scheme, At least eight regional airlines have ceased operations in the last two years; particularly small operators. This indicates that small operators are not able to achieve financial viability on the routes allotted to them. Among the airlines that have stopped flying are Air Odisha, Zoom Air, Air Carnival, Supreme Airlines, Jamshedpur Air Connect, North East Shuttles and Air Costa. The reasons for their closure are high costs, scarcity of airport slots, maintenance woes, inadequate manpower, and the inability of promoters to raise capital.

Can this Growth be Quantified?

We can estimate future revenue for an airline by understanding various factors affecting the revenue. For an airline, we can arrive at revenue by considering the number of passengers and revenue per passenger.

To calculate the number of passengers we can use two approaches

- Under the first approach, we can use other data sources like CAPA to assume what will be the number of air passengers in India for the next few years and make assumptions about company’s future market share in air passenger during that period. With these two data points, we can arrive at the number of passengers for a particular company.

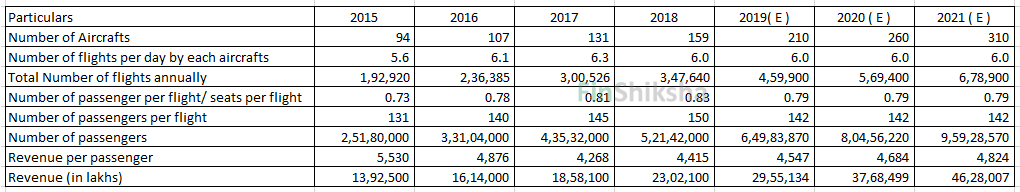

- Another approach can be explained with the help of the following illustration on Indigo

- Number of aircrafts

- Total fleet size as on 31st Dec 2018 was 208. Indigo had an order book of 411, A320 neos as on 31st March 2017. The company had also placed an order with ATR for the purchase of up to 50 ATR, 72-600 turboprop aircraft in August 2017.

- In 2017-18 company purchased 6 ATR and bought approximately 22 aircraft on lease.

- Assuming that the company will purchase or lease remaining aircraft from the order book in 9 years, the company will add a net 50 aircrafts to its fleet each year.

- Number of flights per aircraft each day

- It has historically been around 6 flights per day hence we assume that it will continue to be 6 flights per aircraft per day.

- Total Number of flights annually

- The total number of flights annually is obtained by:

- Number of aircraft * number of flights per aircraft per day* 365

- Number of passenger per flight/ seats per flight

- This is an occupancy ratio arrived by dividing the number of passengers per flight by the number of seats per flight.

- We have assumed it to be an average of the last 4 years i.e. an average number of passenger per flight/seats per flight from 2015 to 2018 which is 78.5%.

- Number of passengers per flight

- The number of passengers per flight is calculated by multiplying the number of passenger per flight/seats per flight (occupancy ratio) to the number of seats in one aircraft.

- The number of seats in one aircraft has historically been 180 seats per aircraft. Hence we assume it to be constant.

- The total number of passengers:

- The total number of passengers indigo will serve can be arrived by multiplying the number of passengers per flight to the total number of flights.

- Revenue per passenger:

- Revenue per passenger increased by 3% in 2017-18. We have assumed that a similar trend will be followed in the next 3 years.

- Total operating revenue:

- This is arrived by multiplying the total number of passengers to total revenue per passenger.

The above methods are not comprehensive methods. There can be several other ways of determining the future revenue of an airline. However, to initiate the report one must start using revenue and cost parameters. A similar exercise can be performed for other companies as well for comparison. There can be certain drawbacks of using the above methods. One of the drawbacks can be that estimation is based on the assumption that the company will purchase a certain number of flights each year, occupancy and growth in revenue per passenger will remain constant. If any assumption doesn’t hold true than the revenue will be affected. However, whenever we come across any new piece of information affecting our assumptions we can adjust our assumptions with the new information.

Just to conclude, first of all, the fact that this industry is very tricky when it comes to analysis as there are a lot of externalities present. Market structure is such that price can’t be dictated that easily. Operating leverage is at play. We have covered that in more detail as a part of this video. What we need to understand is that there’s growth available in this particular sector in emerging markets like India, and historically, across the world lot of investors have found this industry very lucrative. However, also to be noted is the fact that over a longer period of time historically this industry has not created any significant wealth. Interestingly, Warren Buffet recently invested in the Airline Sector through Southwest Airlines; which probably suggests that some industry dynamics are changing and so is the thesis. The Indian Aviation story is also one of an emerging sector in an emerging economy. This sector has been supply constrained for a long while and has just now started finding its feet. If costs remain under control, this could be an interesting sector to watch out for in the Indian consumption story. Of course – one must keep a key eye on the risks in this particular sector and study finer aspects before we take a final decision related to investment. With that, we conclude this series related to the Airline Industry.