Disclaimer: These notes are purely for the purpose of financial analysis and education. These are not to be construed as recommendation to either buy or sell any asset class or security.

The Vakrangee Saga

The stock of Vakrangee has been in the news recently due to its volatile price movements. The stock has fallen from a high of above Rs 500 to below Rs 200 as we write this. This was a Rs 50000 crore market capitalization company, before this fall. The company serves the rural retail market, and on its website mentions this – “Building the World’s Largest Rural Retail Network – Vakrangee Ltd aims to be the last-mile link that connects rural citizens with India’s modern ecosystem. We endeavour to bridge the financial inclusion gap between the developed urban India and the under-developed rural India by serving a 700+ million people market through Vakrangee Marts.”

So what triggered the fall? This news that seemed to suggest that SEBI would investigate price rigging claims in the stock. Around the same time – the company bought 0.5% stake in PC Jeweller by spending Rs 120 crore.

While the first news is clearly going to rattle investors, the second news has a bit more to it. The investors would surely question the logic of Vakrangee buying a stake in PC Jewellers, more so since it is an unrelated business, and if investors wanted an exposure to the jewellery sector, they could have invested directly in PC Jewellers or other companies. Why would I invest in Vakrangee only to find them investing shareholder money in PCJ? But more on this later. Immediately post this, both stocks tanked, and Vakrangee issued a clarification on their website

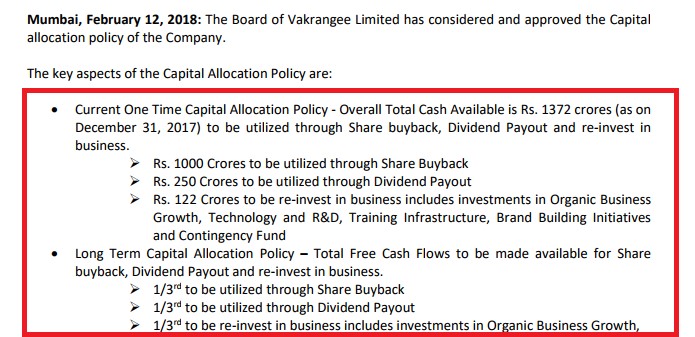

Post this, they also announced a buyback plan.

The stock briefly jumped on this plan, only to sell off again. As an analyst, we maintain that our job is to ask questions that come to our mind when we read all this, and go ahead and ask follow on questions if the answer is not convincing for the first set of questions. So the first set of questions that come to our mind are

- Why would Vakrangee invest in PC Jewellers?

- Surely the management of a Rs 50000 crore market cap firm understands that the stock market will react negatively to this?

- Off all the companies listed on the stock exchanges, why would they pick only PCJ?

To answer the first question – let’s see if the company has done any such thing in the past. The annual report and notes to accounts should show this. So let’s dig into the annual report for FY17, and look at the numbers.

The numbers are in Rs lakhs. The company has invested Rs 56 lakhs in current investments and Rs 1.28 crore in long term investment as at the end of 31st march, 2017. They also have cash and cash equivalents of Rs 582 crore.

Page 223 of the Annual report – note number 15 shows details of cash. Nearly Rs 520 crore in current account – which, by the way, gives zero interest. Why would someone do that? Surely you could do a Fixed Deposit at the very least.

Even then, let’s give the company a benefit of doubt – and suggest that maybe they have money in investments during the year, and only redeemed it at the end of the year. So surely they must have some investment income in the P&L – other income for this Rs 500 crore of cash. Let’s gauge that. Note number 34 shows that.

Interest income is less than Rs 2 crore! Even assuming that they had nearly Rs 140 crore at the end of last year as cash balances, and Rs 580 crore this year, so on average they should have had nearly Rs 350 crore of cash during the year. Rs 2 crore other income on deposits is a 0.6% return. Surely the management could do better here. Either this money just came in towards the end of the year, or the management is really risk averse! If the money came right at the end of the year, did it just mean to show the investors that this is a cash rich company?

Even then, let’s give them the benefit of doubt, and suggest that they are risk averse, and like to keep the cash handy for opportunities. Now, if that is the case, the following sequence appears.

- We have a company whose management is really risk averse, keeps Rs 500 crore in current account last year.

- They do not invest that money in Fixed Deposits, Liquid Funds, any Debt Mutual Funds and surely no equity Mutual Funds.

- This year, the treasury team suddenly decides to invest Rs 120 crore (which is nearly 10% of the cash they claim to have on 31st Dec 2017) in a direct equity – PC Jewellers.

Does this make sense? Why would they do this? Also, the management announces a buyback, and says that based on investor feedback, they will not do any equity investment now onwards. So a Rs 50000 crore market cap company had to try this adventure out in the market to find out the answer to a question which even novice investors know of – investors do not like their money getting invested in unrelated businesses. About the buyback, why would the company wait for this to happen to announce the buyback? Surely, if they have Rs 1300 crore cash, and do not have the opportunity to invest that in the business, they should have done the buyback / dividend earlier before they invested in PCJ.

The final question of why did they choose PCJ is yet to be answered, but let’s just put it this way – as analysts, we are not supposed to believe in coincidences and back luck. There may be more to this story, and surely the PCJ stock investors seem to believe that – the stock is down nearly 35% post this news.

There are some other interesting observations from the annual report. The company’s fixed assets have fallen nearly 85% – from Rs 272 crore in 2015 to Rs 28 crore in 2017. Consolidated sales have gone up from Rs 2780 crore to Rs 4000 crore over this period. This would mean a fixed asset turnover ratio moving from 10 to nearly 140!!

As per the company – this has happened because the company has gone down an asset light model – the franchise model. Even then, usually, if you own a business, and have a trade-off between asset heavy and asset light model, usually there is something you have to sacrifice for the asset light model. It could be margin, it could be revenue growth, it could be increase cost of standardization. But the company’s operating margin has fallen from 26% to 24% (marginal), sales have gone up nearly 50% over 2 years, and profits have increased nearly 70%, all while Fixed Asset Turnover going up nearly 14 times! What a fascinating business – why wouldn’t everyone do this kind of business?

So something is clearly odd here. The learning for an investor / analyst is – do not take everything on face value. Do not believe in coincidences. Dig deeper into the ratios and numbers, and ask why those numbers are moving the way they are. For example – why would the company earn only 0.6% on cash deposits? Why would fixed asset turnover jump from 10 to 140?

And surely do not jump in to buy a stock only because it has fallen 60%. It could go further, if the numbers themselves are under question. The coming days will give us more clarifications around this, so let’s wait and watch for more info here. Comments welcome!