HUL trades at a trailing Price to Earnings (PE) of 55. Titan – 99. Asian Paints – 92. DMart – 184. Jubilant Foodworks – 80. Nykaa is above 1000!

Is P/E a flawed metric? Does it convey what it is supposed to convey?

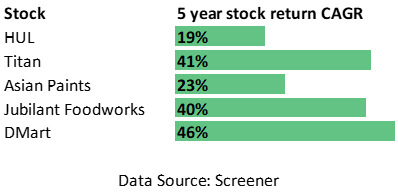

Remember however, that some of these companies have always remained expensive. Despite the seemingly overvalued prices, look at the CAGR of returns. HUL has a 10 year CAGR of 19%, Titan 26%, Asian Paints 25%. Jubilant has a 5 year CAGRs at 40%, while DMart, since its listing, has given a CAGR of 46% (assuming listing price – If we assume IPO price at 300, then the CAGR jumps to 70%). And these returns are after having corrected a bit in the past few weeks.

So what gives?

2 points

Firstly, traditional finance metrics were constructed about 50-70 years ago, where predominant companies were in the traditional manufacturing segment – steel, cement, construction, infra. These companies show the value of their assets on their balance sheets. But the companies we are looking at in our discussion above, are companies that are relatively new age. What assets does a DMart, an HUL, a Titan or an Asian Paints holds on their balance sheet? These aren’t asset heavy business models.

The biggest asset for HUL is their brand and distribution network – the power they have with their suppliers and the mindshare they have with their customers. Do we even capture these anywhere on the balance sheet? These are long term moats, and that is why the market gives them value much beyond what is visible on the balance sheet, or their current earnings. The market believes that traditional valuation parameters do not do justice to these companies, since a significant portion of the growth is going to come in future, and current balance sheet or earnings do not capture it.

Secondly, there are very few companies in India which have a clean proven track record of execution, in addition to the business moats described above. This causes almost all institutional investors to be in these companies, thereby increasing the valuation premium further.

Thus, rather than just looking at the P/E and saying a company is expensive, we need to ask the following questions

– Why is the company getting the valuation?

– Is there something that just does not get captured in short term earnings, or the balance sheet?

– Is that sustainable as a competitive advantage?

– Does the company have an execution track record?

– Can the company keep growing (is the opportunity size large enough)?

Think of various companies that are trading at high multiples, and then try and answer these questions. If you are not sure of the answers, then the advantage may not be sustainable. If you think the company ticks all boxes on these questions, then maybe we need a longer time frame viewpoint to understand valuations.

P/E is not flawed. How we interpret it has to be tweaked it for certain businesses. A high P/E may just reflect that the company’s value is not captured completely in its current financials. Which companies do you think will have these advantages in future?

Disclaimer: Does it mean that we buy them at any price? Of course not. This is not a recommendation to buy or sell any of these stocks, but just an attempt to explain why such valuations may exist.

Recent Blog Posts

Understanding BharatPe : You can read it here

LinkedIn Posts

Comparison of Flows in Mutual Funds and Insurance Industry – View it here

If you had to invest in one company for the next decade – which would be it? Do share your thoughts by replying to this email. We will try and talk about some of these company names in the coming editions of the newsletters.

Until next week. Take care! And do remember to forward this to your friends if you liked it.