Why read an annual report, and how to start reading annual reports?

This is the most commonly asked question by many who wish to understand the companies in a better manner, thus help them with a detailed company analysis.

An annual report is the summary of a company’s activities and management’s commentary on yearly performance.

The company publishes the annual report for stakeholders (shareholders, suppliers, regulators, investors). Annual reports give the stakeholders specific insights about the business and operations.

Annual reports are available under the investor relations tab on the company’s website.

Alternatively, one can directly find using the search engine, type company name annual report FY 20XX-XX.

Unlike standardized 10-k reports in the USA, no two Indian annual reports are the same. However, sections in the annual report remain the same across different companies’ annual reports.

At times, one can be overwhelmed by the length of the annual reports, but once you go through multiple annual reports, you will realize that it is actually fun to go through the information. To inculcate the habit of going through it.

So, let’s jump right in and learn how to read an annual report.

Most important items to go through in an annual report

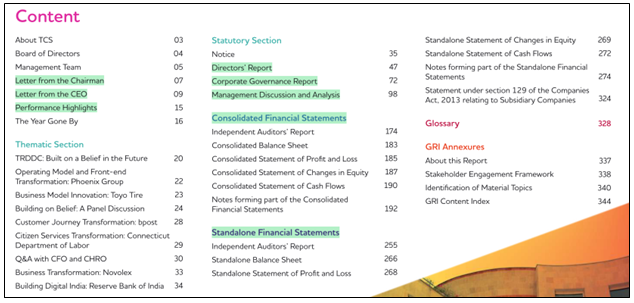

- Company Overview

- Performance/ Financial Highlights

- Management Discussion & Analysis

- Corporate Governance

- Financial Statements

- Statement of Profit and Loss

- Balance Sheet

- Cash Flow Statement

- Independent Auditor’s Report

Part 1: Company Overview

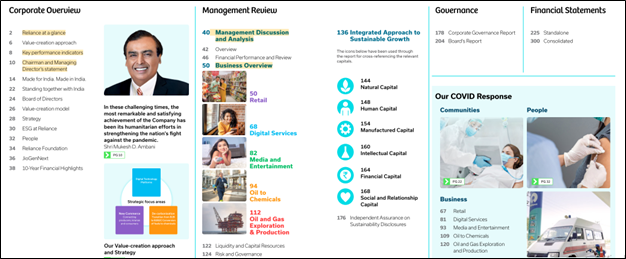

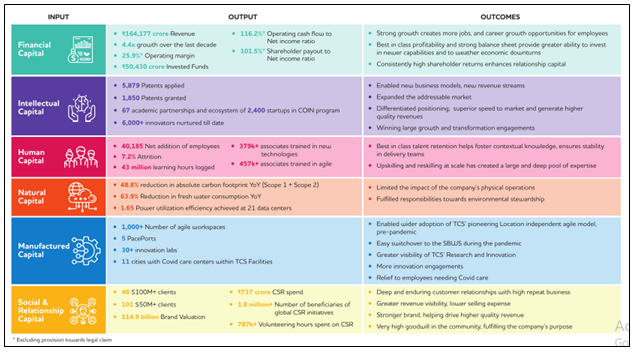

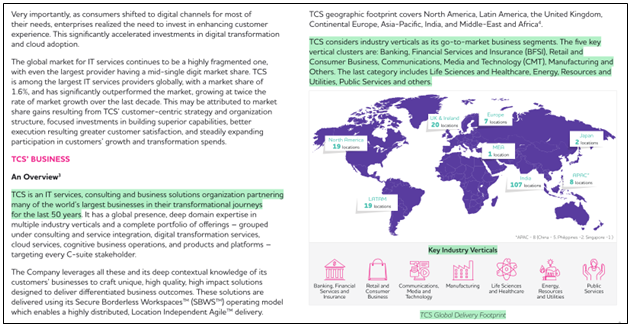

In the company’s overview section, they broadly talk about their business and industry.

If you read about this section of the last 5/7 years, you will clearly understand the company’s direction.

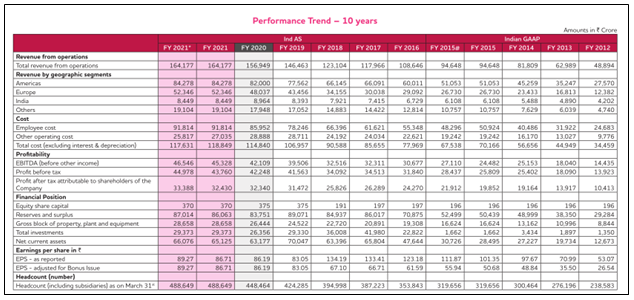

Part 2: Performance/Financial Highlights

It is the summary of financial and ratios related to the company, which vary from industry to industry, through graphs and infographics.

This section is just an overview section. The company will provide more details in the subsequent sections.

***** Cohort Program – AR10 – Annual Report Sprint – Details here ******

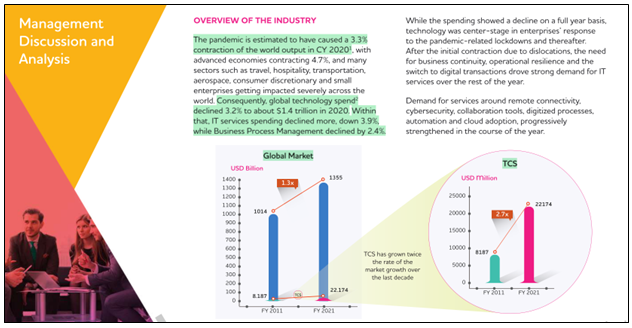

Part 3: Management Discussion & Analysis

This section highlights the various strategies that the company carried out in the previous financial year and how they plan to achieve future goals.

In addition to this, an executive summary is also provided and what happened in the last year economy and industry. It also shows the performance trend of the company.

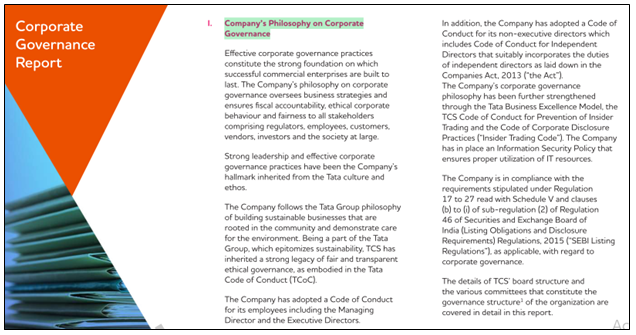

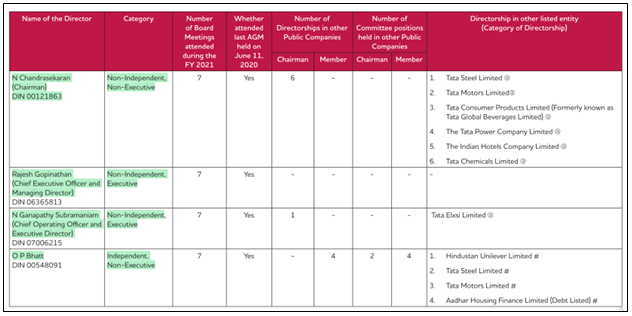

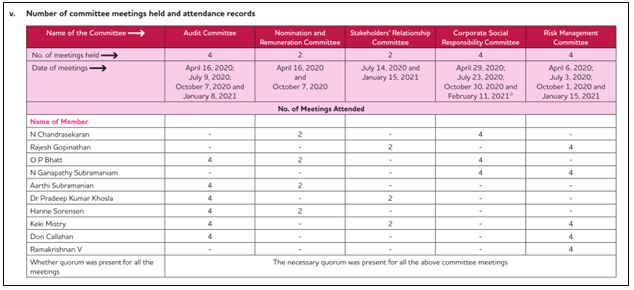

Part 4: Corporate Governance

Corporate governance is the system of rules, policies, and processes through which a company is controlled and directed.

Strong corporate governance gives a sense of security to the investors. It represents the shareholders on the company’s board, significant investors, shareholders rights, companies’ policies, plans to manage long term risks.

Part 5: Financial Statements

Financial statements are represented in the form of:

- Standalone financial statements

- Consolidated financial statements

Consolidated Financial Statements represent the company’s subsidiaries financials, while standalone financial statements do not.

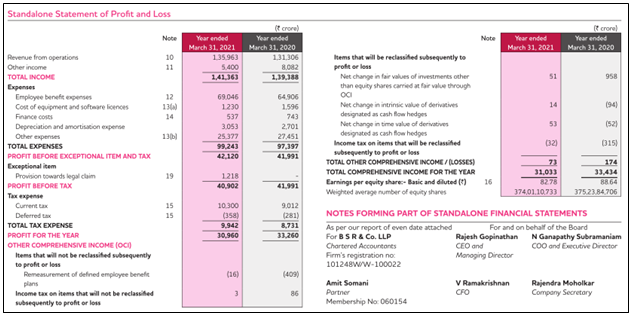

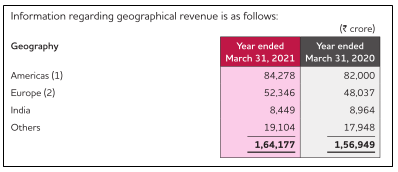

Statement of Profit and Loss –The statement shows Income, Expenses, and other extraordinary items. It indicates the financial performance of the company during the year. Geography distribution of revenue is also given.

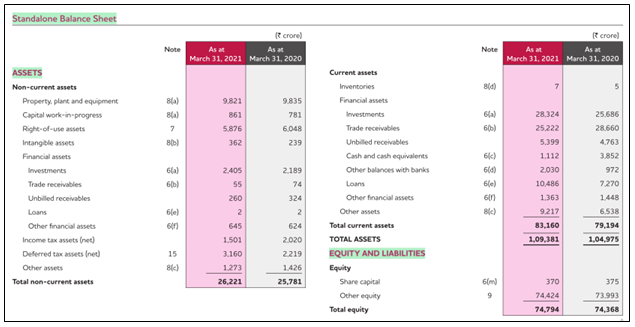

Balance Sheet – It gives the financial position of the company on year-end, i.e. 31st March. Statement of financial position shows assets, liabilities, and shareholder’s equity/fund.

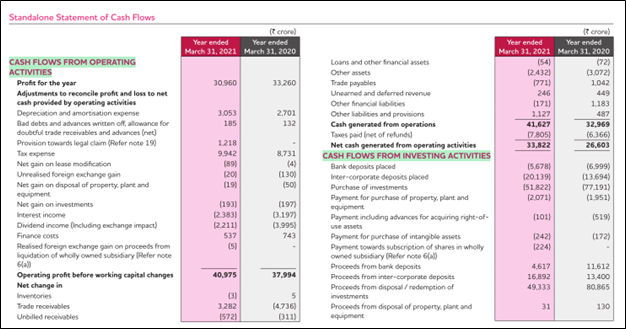

Cash Flow Statement – It shows cash inflow and cash outflow activities of the business. It represents the company’s liquidity, solvency, and financial flexibility. It is divided into three categories – Cash flow from Operating Activity, Cash flow from Investing Activity and Cashflow Financing Activity.

Part 6: Independent Auditor’s Report

After finalizing the financial statements, auditors present their views and opinions on the statements. They review the figures presented in the financial statement and present their independent and unbiased opinion on the reports.

Two main sections of the report are Opinion and auditor’s responsibility.

Types of opinions provided by auditors are –

- Unqualified opinion (auditors are satisfied with the financial statements and the company has complied with all the necessary regulations concerning financial reporting)

- Qualified opinion (auditors are not confident about certain items in the report, and as an analyst, you need to do further analysis)

- Disclaimer of opinion (auditors are distancing themselves from providing any opinion, it may happen if they’re not able to find satisfactory explanations to their questions)

- Adverse opinion (it’s a bad signal for the company. Auditors are not satisfied with the reports and discovered irregularities and misstatements).

The annual report is the best source to get the company’s information and get the information related to the qualitative aspects of the company.

Is that it?

No.

The above-outlined sections are a must when you are starting with the company analysis and annual reports.

Once you get a grip of how to read an annual report, you will find more details on HR policies, average employee salaries, higher management remuneration, and detailed sub-parts of financial statements thought notes.

As an Analyst, you should always dig deep and find answers to the questions about business and the policies followed.

Other Trending Post in this Series – India’s Demographic Profile | Understand 10k Report | Macroeconomic Data

To stay updated about all of our posts on Businesses and Finance Careers – register and create a free account on our website. You will also get access to a free Finance Bootcamp course once you register.